Using the Dashboard to Discover Investment Trends.

At IT-Harvest we are very serious about moving fast. We take advantage of no-code methodologies and OpenAI to quickly add amazing features. If you have followed along over the 24 months since we launched you have witnessed the amazing advances that Maximillian has achieved. We launched with an Airtable back end. Maximillian switched to bubble’s database after a couple of months and then re-architected to use Xano on the back end for better security.

All the while we continued to add vendors and data points to the Dashboard.

The UI changes rapidly too. Compare last week’s demo of v6 to this walk through I posted in November of 2022.

We are grateful to our many users who constantly make suggestions for enhancements which Maximillian jumps on right away. Without these ideas we could not have achieved so much.

The latest such request was to create tools to examine trends in investments by looking at the portfolios of VCs and PE firms. Here is a video tutorial I made of these new capabilities.

Basically you use our investment search tool to find investors and add them to a special investor list. You can then see an analysis of their combined portfolios.

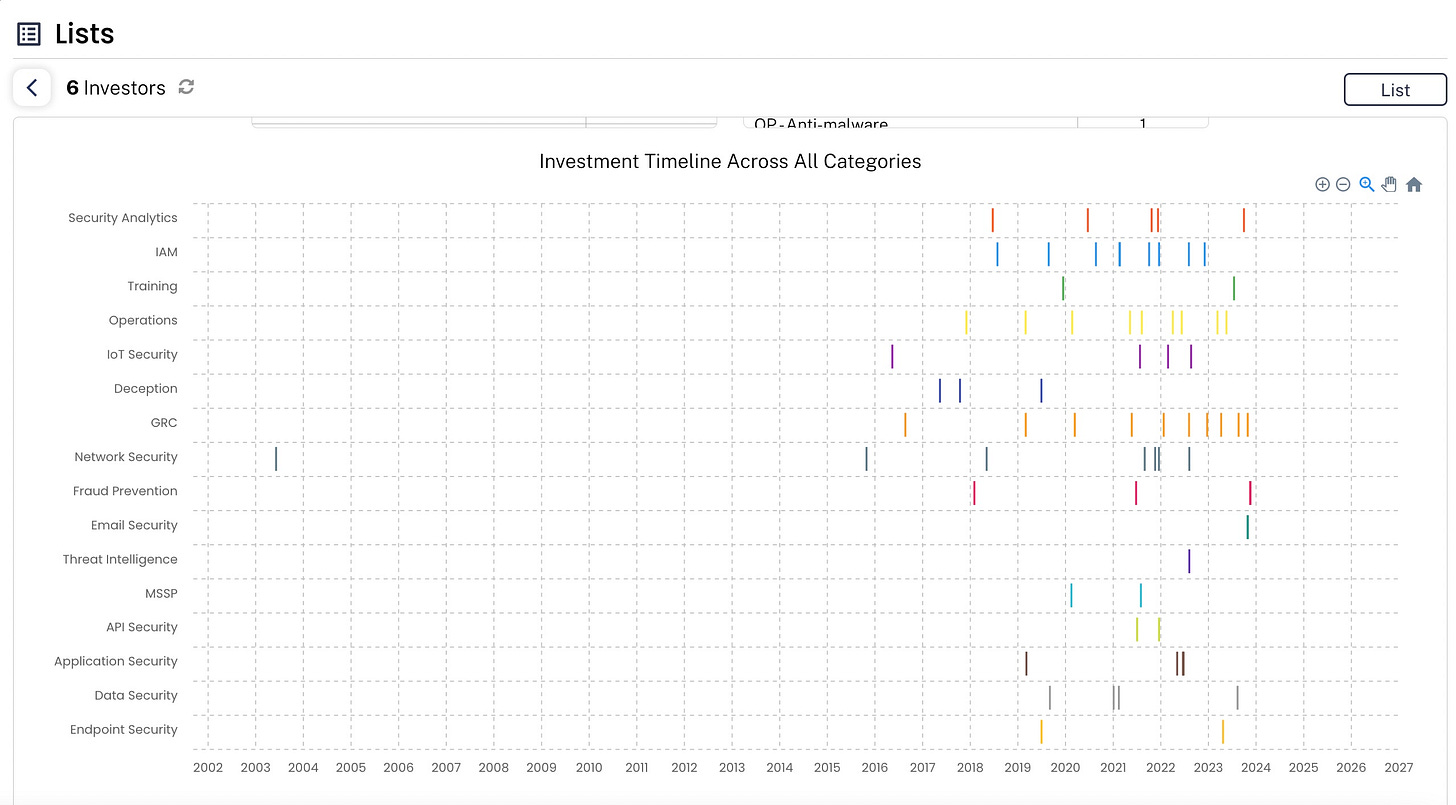

Scroll down and you can see a timeline of investments by category.

Notice that among the investments made by these six (Bessemer, Bright Pixel, SYN Ventures, ForgePoint Capital, Andreessen Horowitz, and Allegis Cyber) there is an accelerated interest in GRC vendors.

And here is what the list view looks like.

Keep watching as we move on to the next phase of our efforts. You will be able to say you followed our journey from the early days!

Richard - You and Maximillian have created something truly unique in the market research space - really impressive!