On Wednesday, March 30, 2022, the press release announcing the Analyst Dashboard hit the wire at 8:25 AM.

This SaaS tool has been built primarily to serve the investment community of private equity and VC firms. It is bundled with the the advisory services that IT-Harvest has been providing to investors, vendors, and CISOs, since 2005.

In effect, this makes IT-Harvest a data-driven industry analyst firm. Most analyst firms create research notes, reports, and market guides, as well as provide advisory services. None that I know of provide access to their complete data set which they base their reports on.

On the other end of the spectrum there are data providers like Pitchbook, Crunchbase, Sourcescrub, and Craft.co. which sell subscriptions to their data. They even provide APIs to automate data delivery to other tools. Their scope is breathtaking as they claim over three million companies tracked. The one thing all of these companies would benefit from is a team of industry specific experts to help categorize what the many vendors actually do. A search on Pitchbook several years ago for “Cybersecurity” turned up over 6,000 results. All but 2,000 of those were consulting firms, investment firms, resellers, or distributors. Even analyst firms were included!

An “industry specific expert” is another name for an industry analyst. Recruiting, retaining, and managing industry analysts is far different than finding and keeping researchers who manually scrape data from the Web.

Pitchbook employs 1,099 people to gather and update data. A subscription costs something like $18,000/year. Crunchbase employs 236 people and makes their data available for a monthly fee of $49.

SourceScrub has 646 employees, while Craft.co employs 72.

Meanwhile, Gartner employs 18,843 people to support about 1,200 industry analysts. A “seat” with Gartner can cost between $28K and $48K, or higher.

In addition to the investor use-case, the early demos we have done of the Analyst Dashboard, has illuminated more use-cases:

Marketers to security vendors include events, training, PR firms, search firms, and publishers. They want to identify prospects for their offerings and have that knowledge of size (headcount), growth, and funding, to prioritize their lists. We are adding more marketing titles to the Dashboard and collecting contact information— data that can be downloaded and put into a CRM tool.

Corporate development people are tasked with identifying prospective acquisitions. They too are interested in growth and investment histories. They also take advantage of the analyst’s perspective on the potential for both the category and particular vendors.

Competitive intelligence teams build lists and track competitors in many categories. Using the Analyst Dashboard can shorten the time to collect those lists and save many hours of research.

Investment bankers are the ones who facilitate M&A deals. If they want to get into the cybersecurity arena, the Analyst Dashboard can get them up to speed quickly.

Since we launched three days ago we have been experiencing the advantages of a SaaS solution. We can add new features every day and start to build automated processes to enhance the data.

The Leaderboard and Watchlists now display vendor logos, which is a nice improvement.

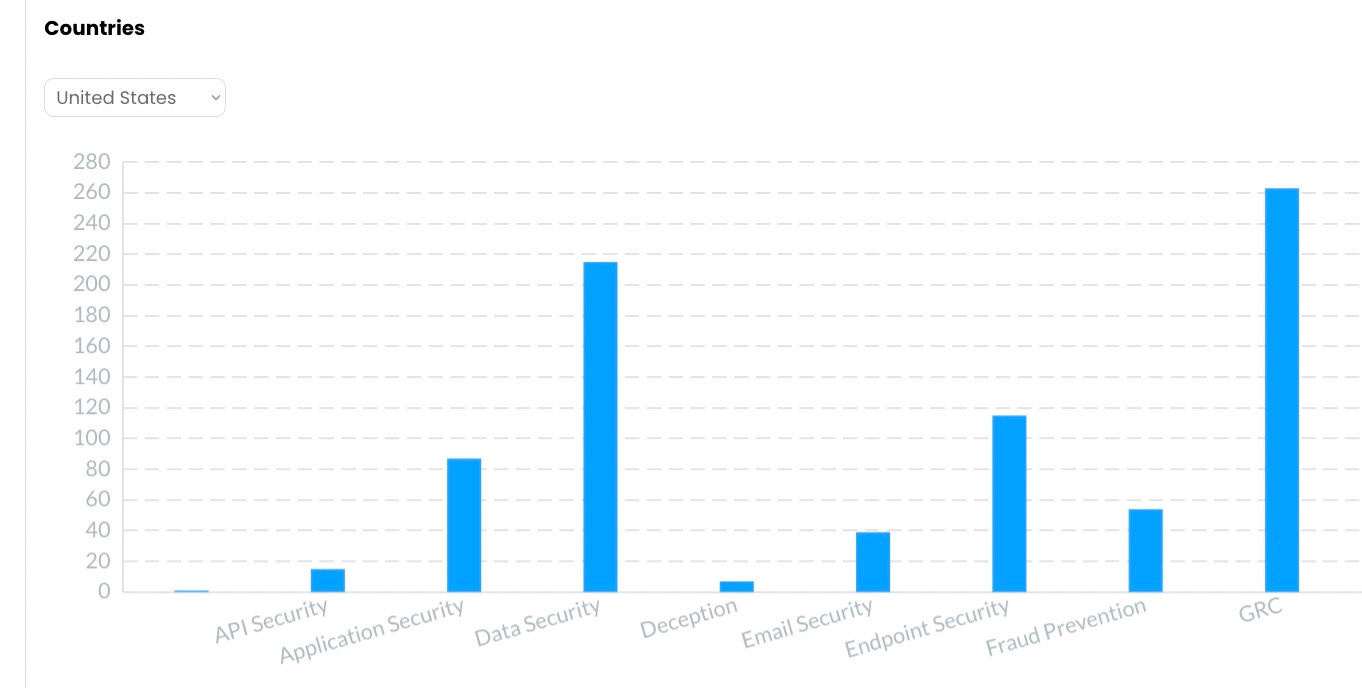

Subscribers can scroll through 2,800 vendors in this view if they are so inclined. Or they can download all the data in a CSV file to incorporate into their own analysis tools.

Stay tuned for more updates. Reach out if you want a demo.

After 6 months since this was posted there are now 3,094 vendors we track in the Dashboard. Go to dashboard.it-harvest.com