Thanks to Ken Rutsky for posing this question after he saw my Substack about the sparse coverage of cybersecurity vendors in Gartner magic quadrants: Which are the top 10 leading cybersecurity companies that do not show up in Gartner MQs at all?

Unlike Gartner, we do not anoint vendors with labels like “leading.” (We do assign health scores and provide all the data for you to find your next vendor.) But, another question which will make the point could be: Which are the top ten cybersecurity Unicorns that are not in magic quadrants?

These are the hottest, fastest growing, cybersecurity solutions that address the latest enterprise needs. If you are a large enterprise how are you making sure you are using best of breed? How do you research and track these companies?

I am using CB Insights’ complete list of tech unicorns (companies with $100+ million investments and $1 billion+ valuations.)

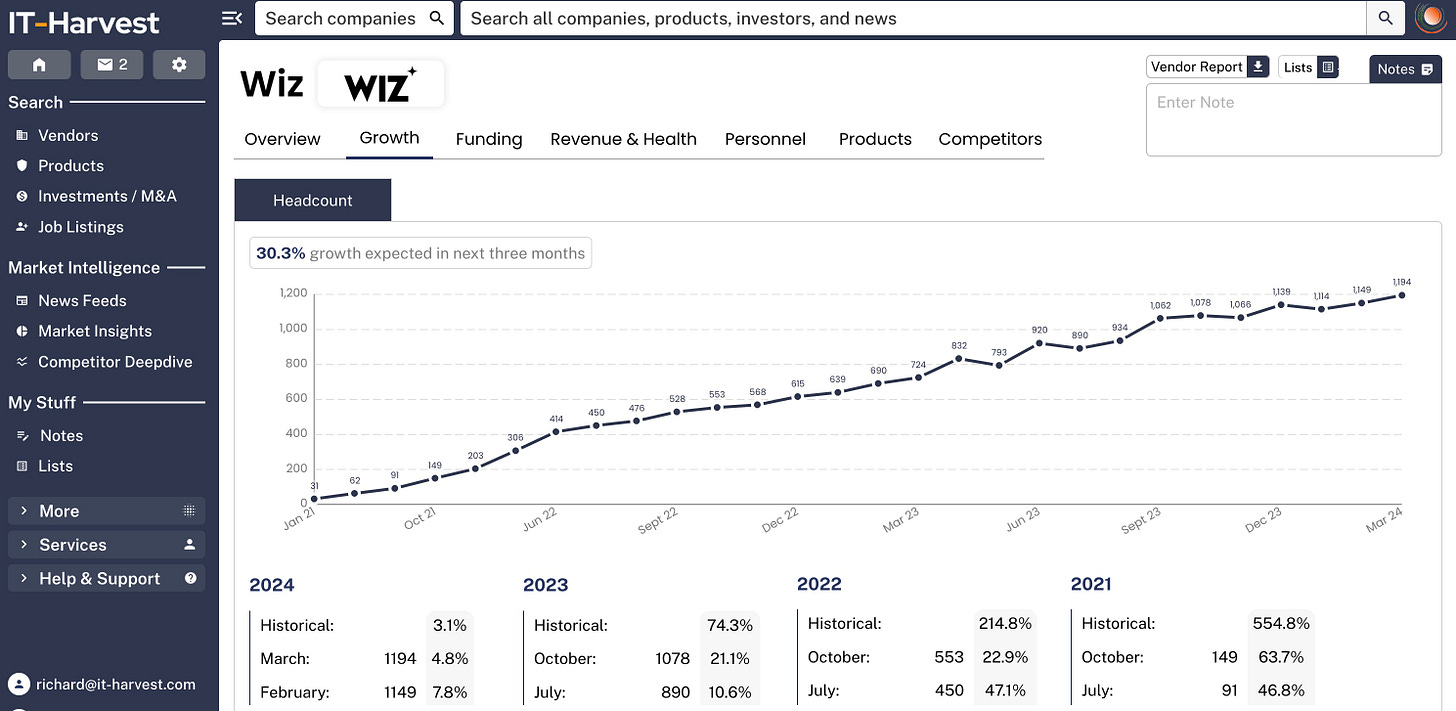

Wiz did not create the cloud security posture management space (CSPM), but it is dominating with claimed ARR of $250 million and a $10 billion valuation. It is not one of the 144 vendors that appear in one of the 25 Gartner MQs for cybersecurity. Gartner may be able to claim credit for coining the acronym, but there is no MQ for CSPM.

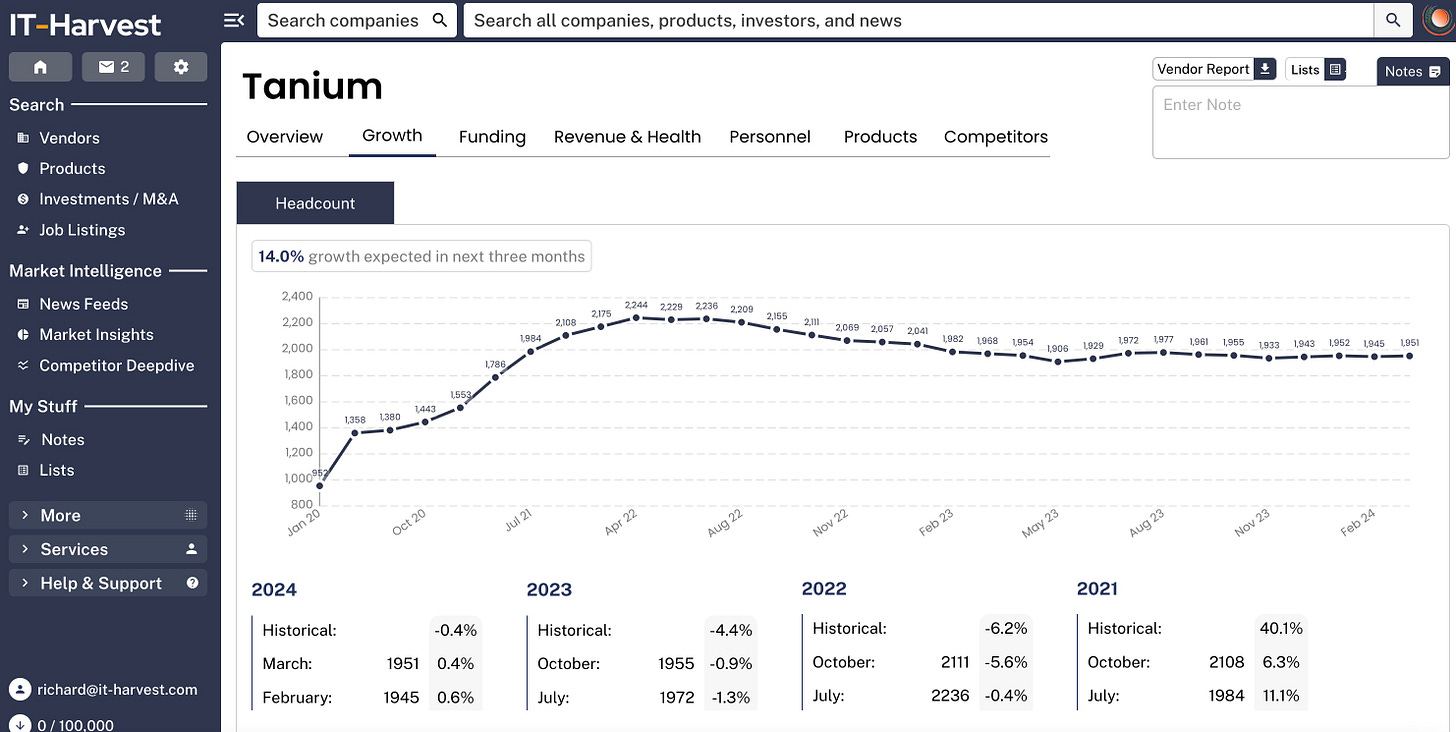

Tanium is valued at $9 billion and yet does not appear in a magic quadrant. It almost made it into the Unified Endpoint Management MQ, which is not technically security.

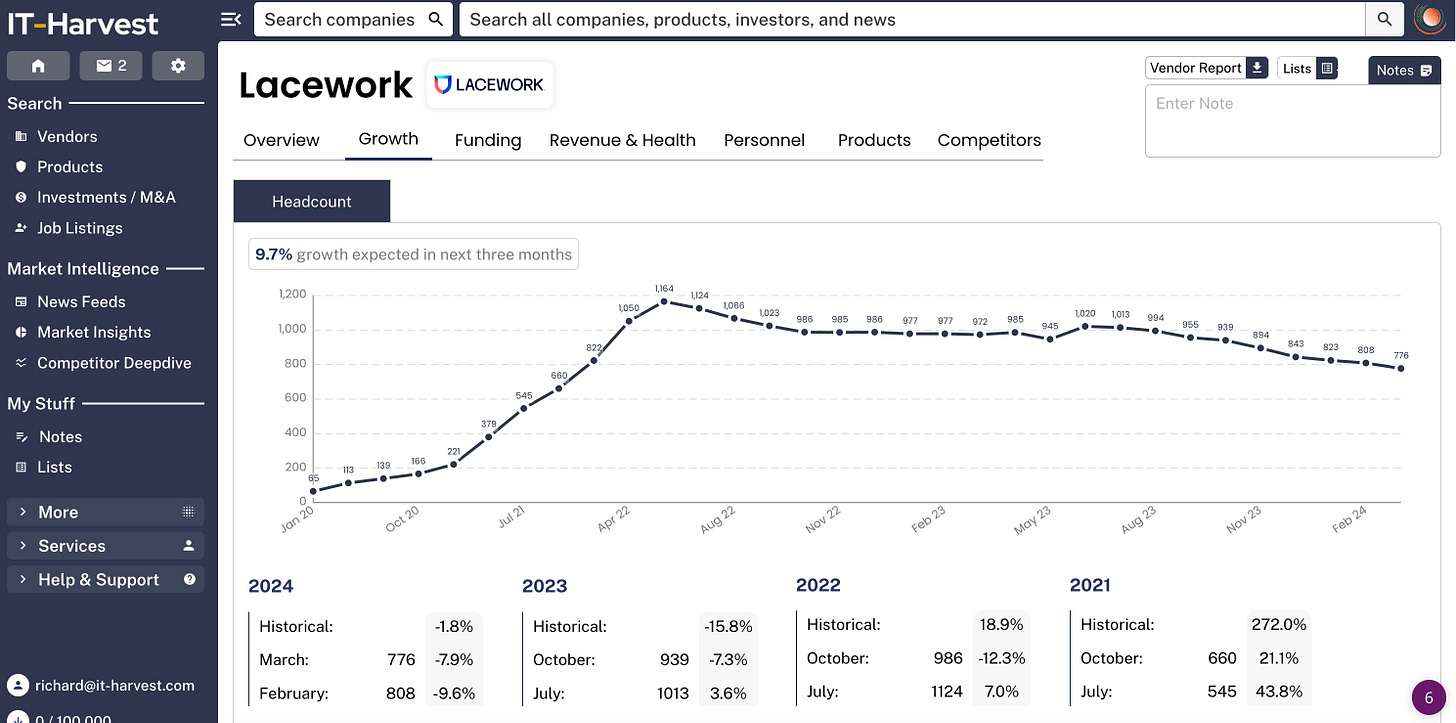

Lacework, with an $8.3 billion valuation, has aligned itself with Gartner’s category of Cloud-Native Application Protection Platform (CNAPP). There may soon be an MQ for CNAPP, but for now Lacework is not in an MQ.

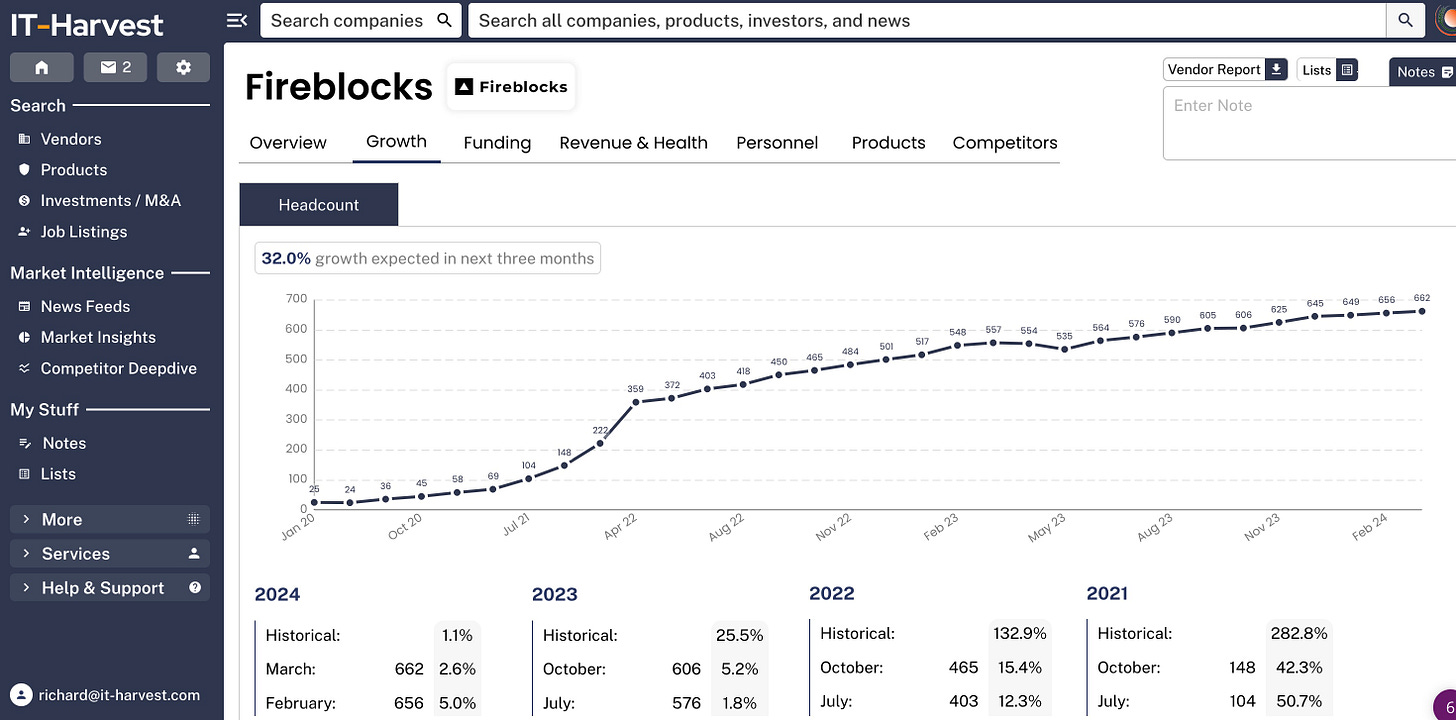

Fireblocks is valued at $8 billion. It is a different kind of unicorn in that it has received over $1 billion in investment for its Web3/blockchainy security stuff which I don’t pretend to understand. I can’t fault Gartner for not having a Web3 Security MQ.

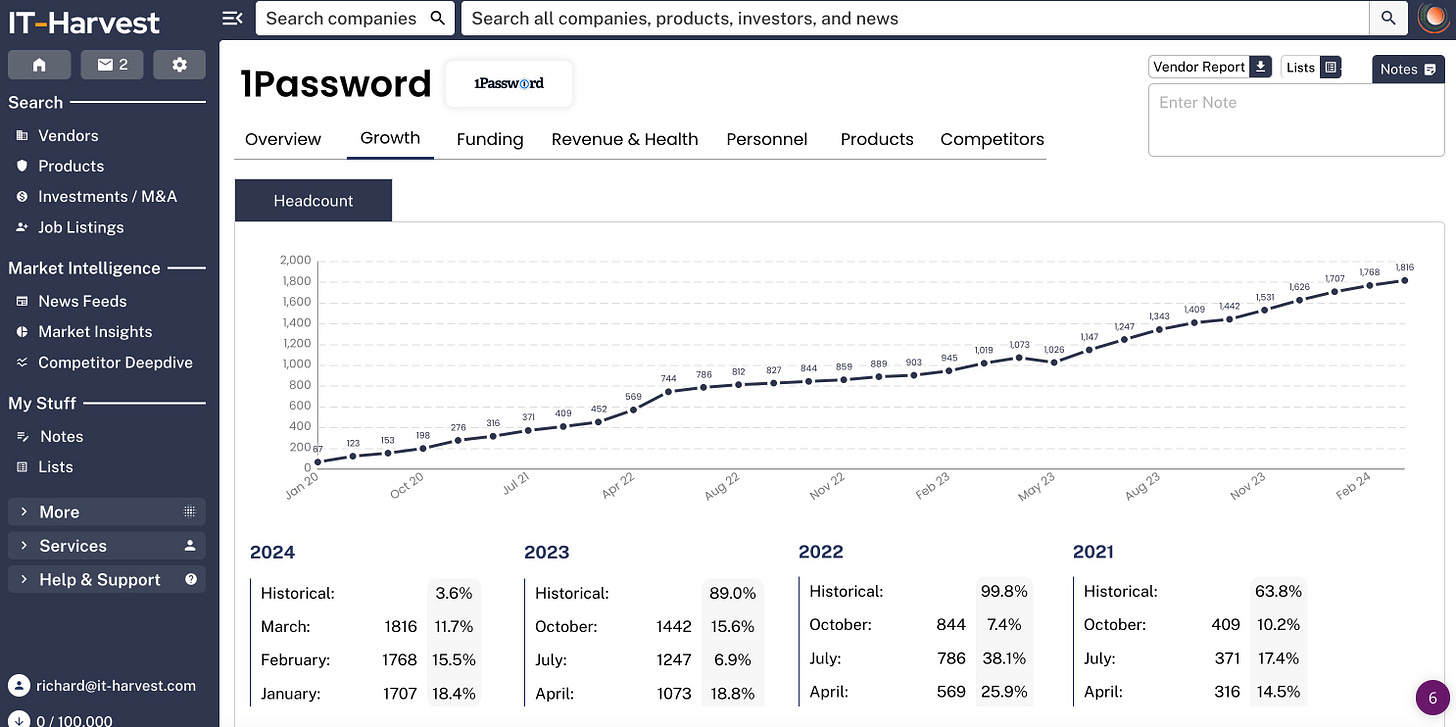

1Password. It is astounding that Gartner has no MQ for password management. A Canadian unicorn valued at $6.8 billion, it is one of the fastest growing cybersecurity companies year over year. It may well IPO before there is an MQ for what they do.

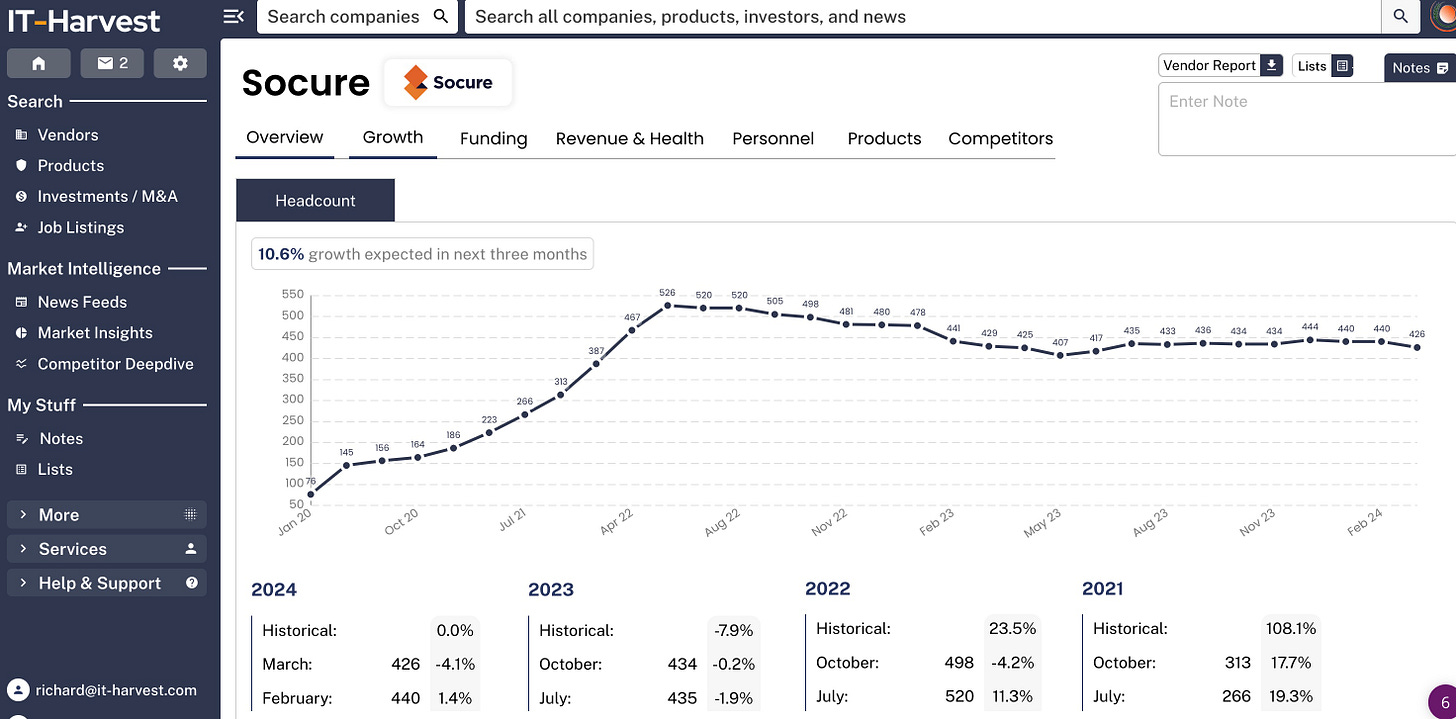

Socure, valued at $4.5 billion does identity verification, a space that has 115 solutions that we have collected so far and we are not done.

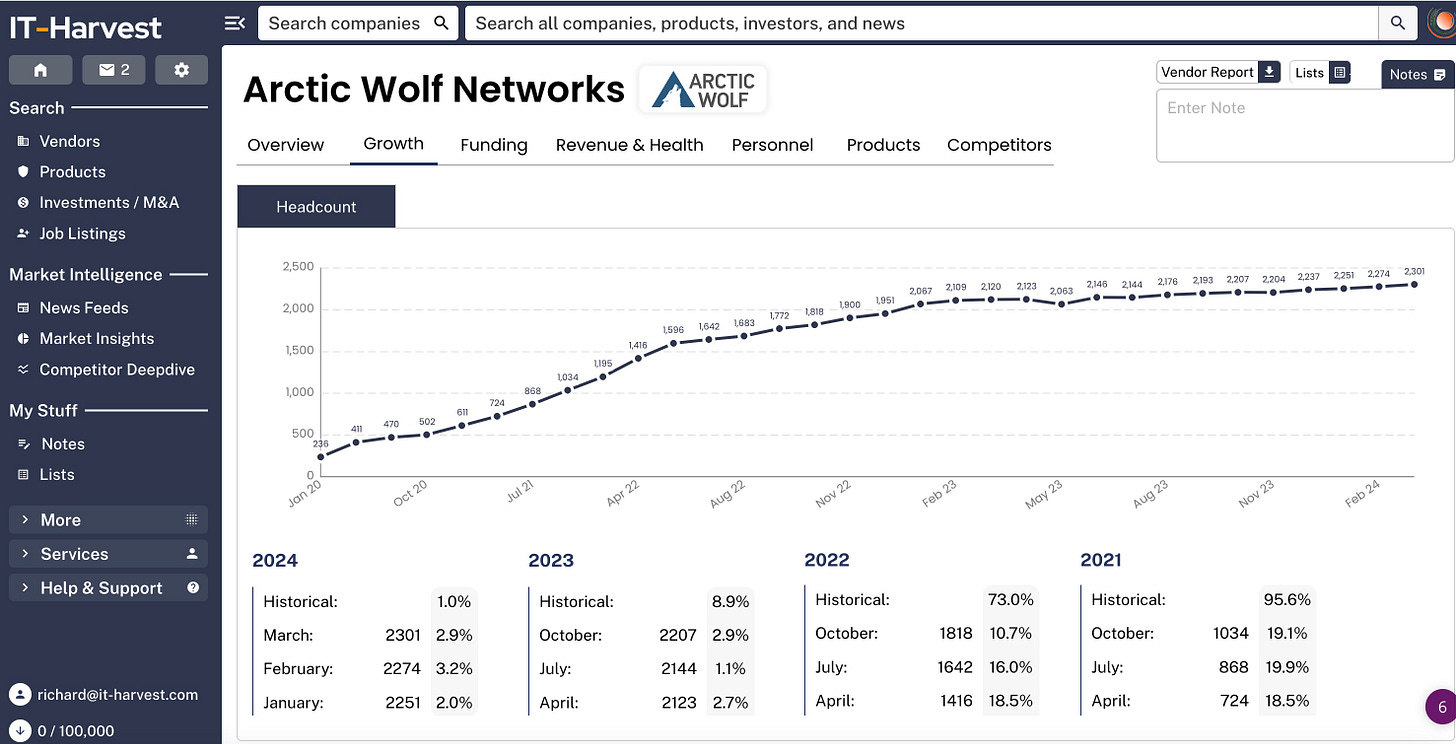

Arctic Wolf, one of the top MDR providers does not appear in the MQ for Managed Security Service Providers which does not appear to have changed much in the twenty years since Kelly Kavanaugh, John Pescatore, and I, wrote the first one.

Abnormal Security is valued at $4 billion. It’s one of the top email security/anti-phishing solutions out there. Too bad there is no Gartner MQ for email security. There are 71 vendors in the IT-Harvest database that focus on email security. There are 149 email security products.

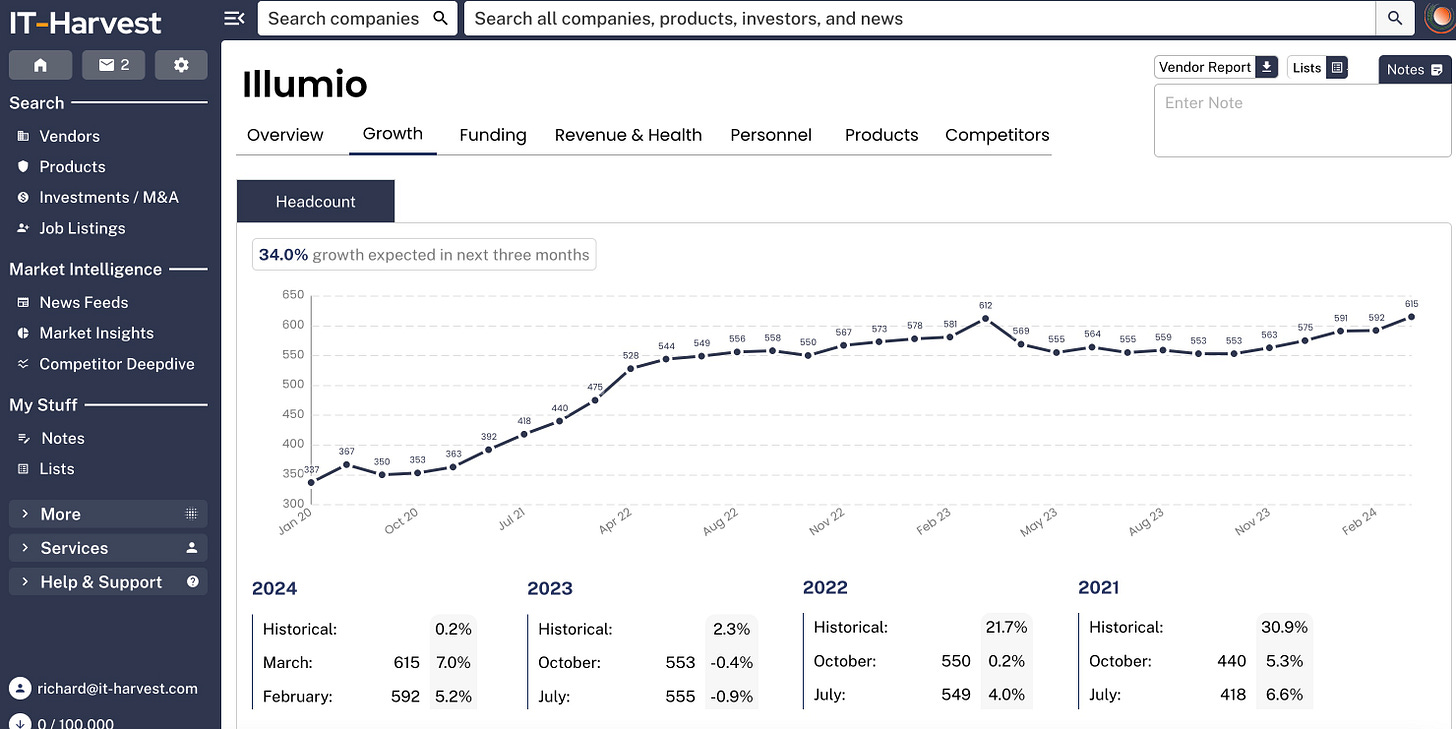

Illumio has $557 million in investment and is valued at $2.75 billion. Micro segmentation is one of the hottest spaces in network security and those who use MQs to make purchasing decisions are left with nothing.

Transmit Security is also in the identity verification space, valued at $2.74 billion. That makes two Unicorns that could be in a magic quadrant.

I am beginning to question whether Gartner is fulfilling the demands of the market for guidance in purchasing decisions. I am sure their customers can schedule inquiries about all these vendors and get good guidance. But I am concerned about the paucity of coverage. The space includes at least the 3,764 vendors we track today at IT-Harvest and there are only 144 covered in Magic Quadrants

.

Methodology:

We used the published list of Gartner MQs to identify the 25 MQs that covered cybersecurity solutions. IT-Harvest researcher, Salaar, found open source images and reprints of the MQs from the last two to three years and identified the partipating vendors. I then collated all the vendors and deduped to arrive at a list of 144 vendors that appear in Gartner Magic Quadrants.

Context: I was VP Research at Gartner, departing in 2004. I am the author of UP and to the RIGHT: Strategy and Tactics of Analyst Influence and Curmudgeon: How to Succeed as an Industry Analyst. I think a lot about the role of industry analysts.

Great analysis @Richard Stiennon

The question is why?

Is it because Gartner analysts spend too much time in customers call repeating what they already wrote and so not doing research ?

I heard this argument quite often

Just checked: Gartner is kicking off an Email Security Platform MQ at the end of the month, planned to be published in early September this year.