Last February about this time I checked in on cybersecurity stocks. I noticed they were all up since January 6, 2022. Most had dropped 50% since November 2021. After just a year, six of the major cybersecurity stocks have more than doubled with Crowdstrike seeing an amazing 246% jump.

There are those that peg economic cycles to interest rates. Surely the 60% dop in the stock market that started in November 2021 was triggered by the fear of rising US interst rates.

Yes the Fed slammed on the breaks. Yet those breaks were fully in effect last January and are still being applied today. What happened to cause the turn around in the stock market? Note that my focus is on cybersecurity which is just a minuscule portion of technology and stocks in general, which have also followed these trends.

Something happened 38 days before January 6 last year. OpenAI released ChatGPT. In those few days over 100 million people signed up for the free version. Not only was that the fastest consumer adaption of anything ever, it completely dwarfed the speed at which people got on the internet decades ago.

I propose that the advent of AI in the form of large language models is going to have a bigger impact on human development than anything that has gone before. Bigger than the printing press, steam, electricity, the telegraph, the computer, or the internet.

People tend to dismiss the dot com boom as a bubble. In their minds once the bubble burst all the impact of the boom went away. Obviously, what remains of the boom is far bigger today than at the height of the bubble. Nobody reading this on their computer or phone can claim that the internet has not chnaged how they work, live, or play.

Sam Altman is right, people cannot recognize exponential changes. Look back at the stock price of Nvidia, the manufacturer of graphic processing units (GPUs) that in addition to speeding up rendering were being used to crunch proof-of-work for the creation of crypto currencies. On January 6, 2023, NVDA stock was trading at $145. Today it is trading at $734, up 404%. Nvidia is valued at $1.8 trillion. Compare that to Intel ($184 billion) and AMD ($283 billion).

So here is the point of this post. If we are at the beginning of a technological expansion that is going to disrupt medicine, material science, software development, and everything else, how should we be thinking of the immediate future? Keep in mind that all of this impact was triggered by GPT3 followed quickly by GPT4 and this week’s announcement of Gemini 1.5 by Google. Take this as a heads up to adjust to a new reality now, because GPT5 is going to be ten times as disruptive and it will likely be released this year.

Just as you should have a plan for major economic disruptions like pandemics, wars, and weather, you should have an early warning system for signs of an economic boom. The earlier you recognize the impact a technology is going to have, the better.

In 1992 I was reading a copy of Midnight Engineer, a magazine for mechanical engineers that were working on their side gigs. The editor asked one entrepreneur to what he attributed his early success. His answer was “the Internet.” I remember thinking “what’s that?” Within months I had dropped everything and started an ISP called Rustnet. This is one of those moments. Generative AI is bigger than the internet. This is not the Segway (pundits claimed it would change the way cities are designed.) This is not blockchain, NFTs, or web3. This is real.

A few thoughts applied to the cybersecurity industry.

Investors and startups. You got got spooked by the failure of Silicon Valley Bank. You tucked your tail between your legs and hid under the bed until the storm blows over. But now you are under invested. Your portfolio companies are strapped for cash just when the shift back to growth and market capture is going into high gear. Companies are laying people off at horendous expense. They will recognize the need to start hiring too late. Your early warning is going to be when they beat their quarterly numbers. When that happens you are going to wish they had started preparing for growth six months ago.

Buyers of security. I know most of you did not decrease spending, but you may have delayed projects. In the security world you are constantly accumulating technological debt. If you pushed off that MFA project to satisfy your skittish CFO and did not suffer a breach it’s not because you are smart, it’s because you were lucky. Get those projects completed and accelerate the next one. You too should start hiring.

Pundits: We have not entered an era of profitability over growth. During boom times growth is everything. The cybersecurity industry is not consolidating and failures are running close to their historical numbers.

If I have not triggered a change in your thinking take a few seconds to watch this video generated from a text prompt to OpenAI’s new text-to-video product called Sora released yesterday. Thanks to Shelly Palmer for pointing it out along with the text prompt used.

"Drone view of waves crashing against the rugged cliffs along Big Sur’s Gamboa Point Beach. The crashing blue waters create white-tipped waves, while the golden light of the setting sun illuminates the rocky shore. A small island with a lighthouse sits in the distance, and green shrubbery covers the cliff’s edge. The steep drop from the road down to the beach is a dramatic feat, with the cliff’s edges jutting out over the sea. This is a view that captures the raw beauty of the coast and the rugged landscape of the Pacific Coast Highway."

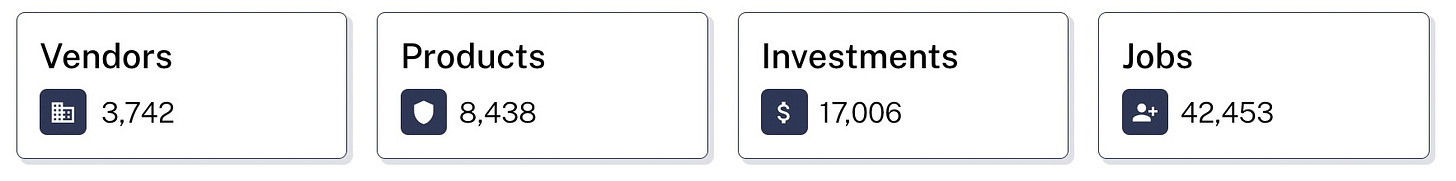

IT-Harvest was already investigating how to leverage LLMs to help categorize vendors when GPT 3.5 was released. We were lucky to have an immediate application for it. It can’t do categorization yet, but GPT4 is great at extracting data from web pages and writing summeries that strip out marketing fluff. The Analyst Dashboard tracks data on 3,742 vendors, 8,438 products, and 8,000 investors.

Richard, thanks for the inspiring and optimistic post!

Not sure, I agree with GPT3/4 is bigger than the internet innovation, but it's definitely a pivotal moment, and everyone should see how they cope with the change.

Awesome post