The IT-Harvest Analyst Dashboard is the only platform for researching the entire cybersecurity industry. This is a report on how the industry fared in the first quarter of 2023.

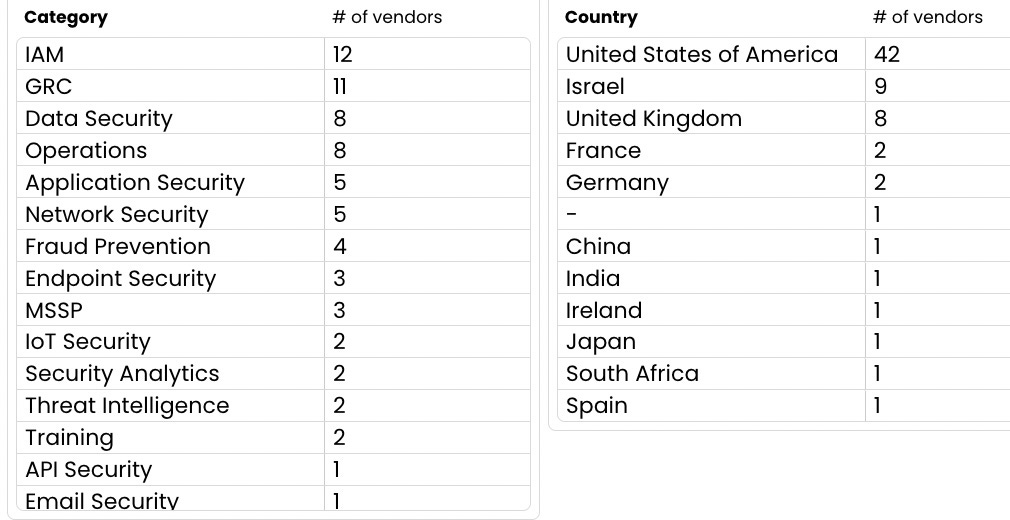

There were 71 vendors that took in new capital. They were spread across 16 of the 17 categories we track, Deception was the one category with no new investments. As usual, the US led in funding rounds, followed by Israel and then the UK.

Last year saw 330 total investments, so Q1 is running at a lower annualized rate of 284.

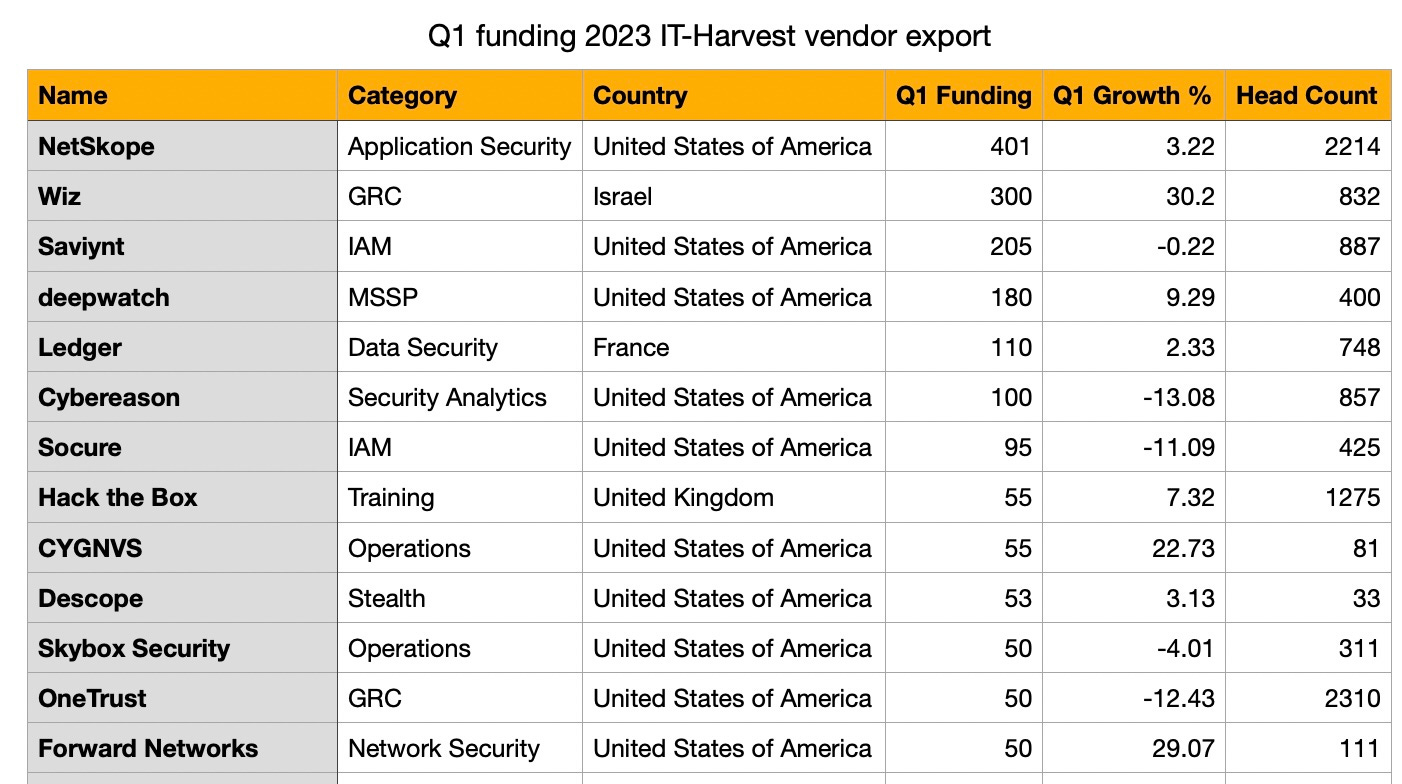

The top rounds below were all over $50 million, with NetSkope taking in the largest round of $401 million and Wiz taking in an additional $300 million at a $10 billion valuation.

Total funding was $2.413 billion, on track for a paltry $9.6 billion which will fall short of 2020’s $10 billion (which was a record at the time.) When I was a Gartner analyst we pegged the entire industry at a $2.2 billion market.

One explanation for the short fall in new funding rounds could be that the March collapse of Silicon Valley Bank disrupted deal flow across the entire tech center. We will know if that is the case as Q2 plays out. An upswing in activity may be explained by delayed Q1 deals.