The Fastest Growing API Security Vendors

An IT-Harvest Cyber 150 Report

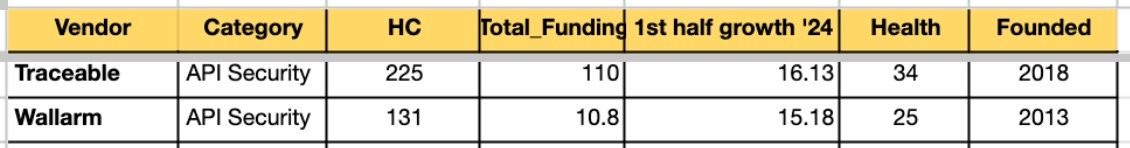

Today we are going to look at the API Security space. In particular, a drill down into the two API Security vendors that made it into the IT-Harvest Cyber 150.

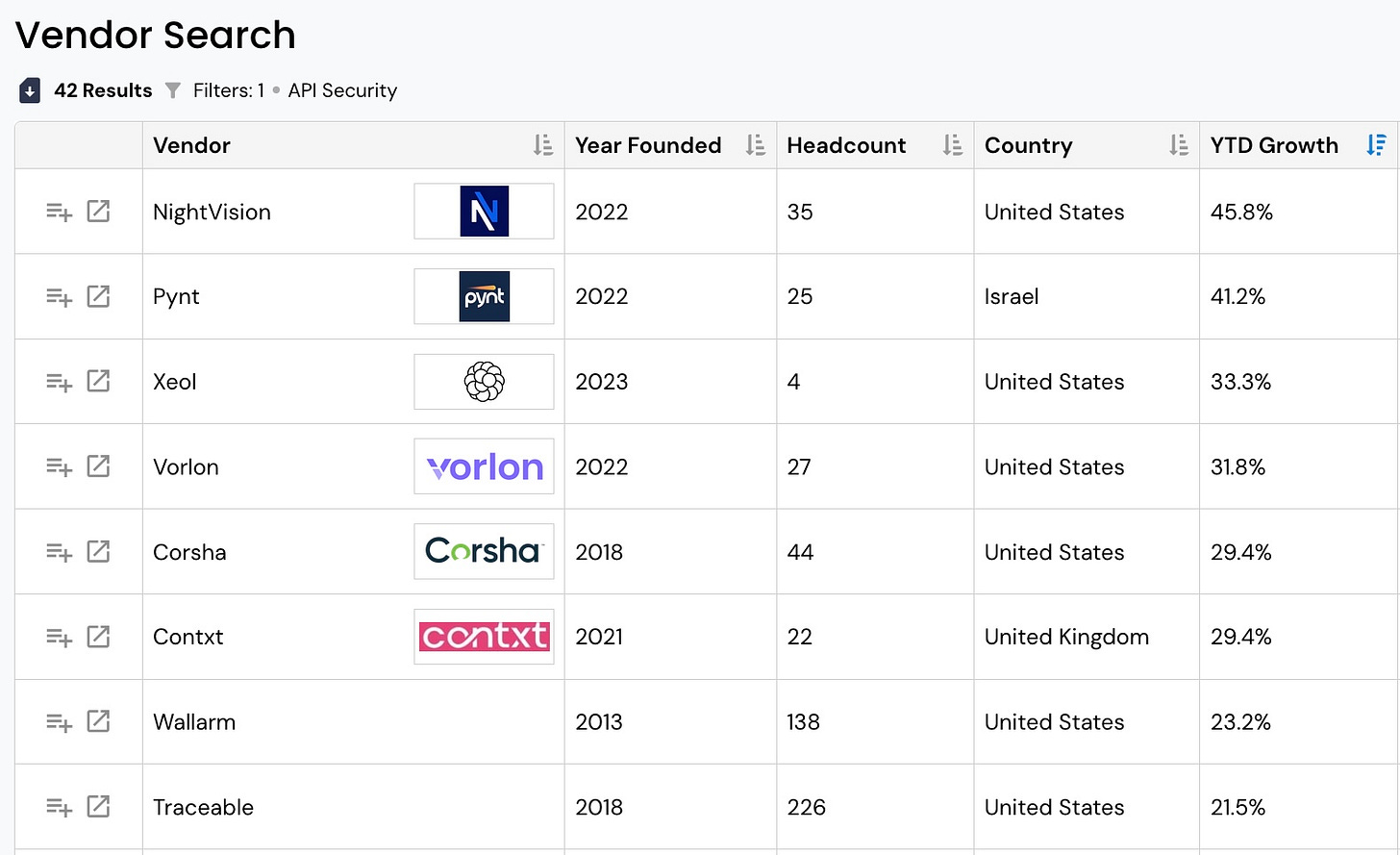

Traceable and Wallarm stood out from the pack of 42 API Security vendors tracked in the IT-Harvest Dashboard. Note how the arbitrary lower cutoff of 50 employees still leaves lots of room for investigation of promising startups. The below screen capture from the Dashboard show growth YTD up to August 4th. Note, there were 6 API Security vendors that grew faster than the awardees. But also note that they are smaller companies.

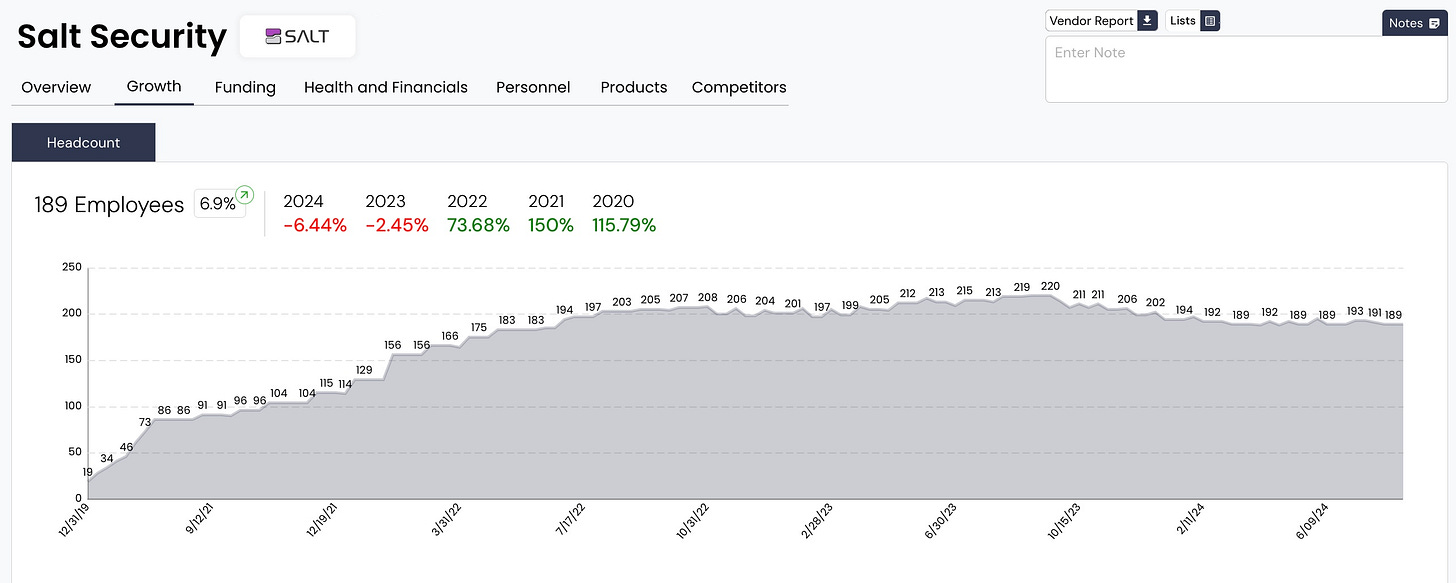

So where are Salt and Noname, the early movers in this space?

Salt has continued its drop begun in 2023 and is off 6.4% so far this year.

Noname is soon to be no more after being acquired by Akamai in May. It has been near impossible to track Noname’s actual head count because so many people think it is clever to select “Noname” as their employer.

Even in this view Traceable and Wallarm stand out, fast growth amid a field of slow or negative growth companies.

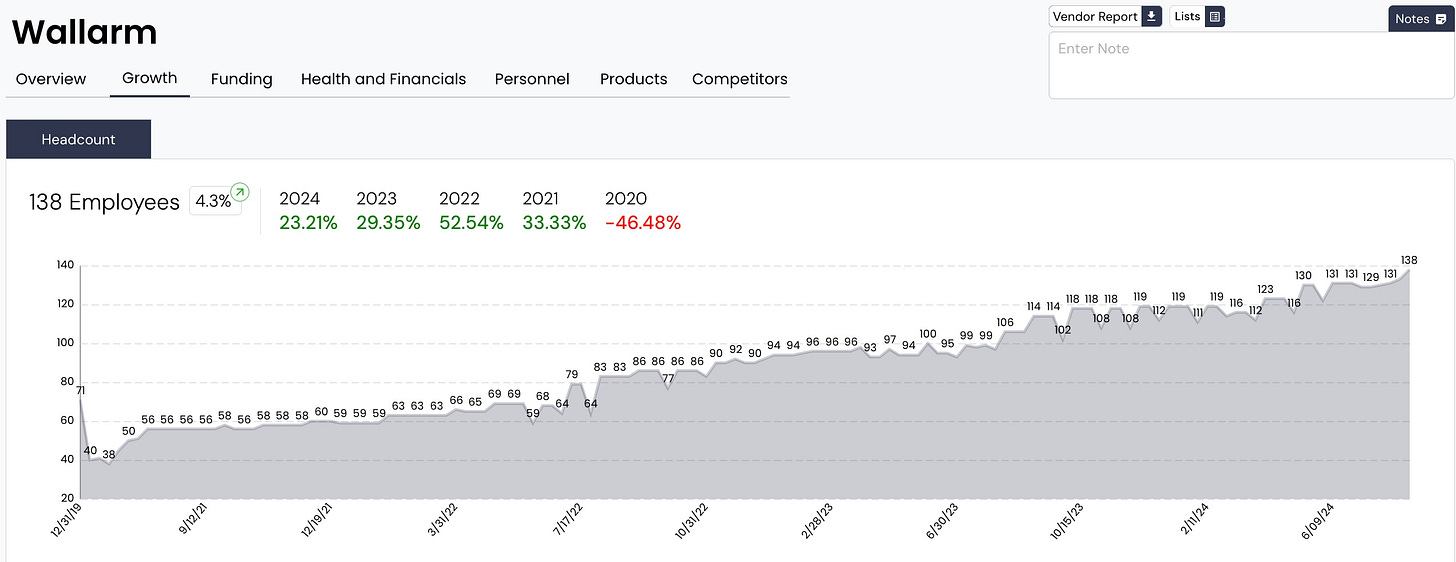

Founded in 2013 Wallarm has “only” taken in $10.8 million in funding with its $8 million series A collected way back in October of 2018. That tells me that recent growth has been completely funded from revenue.

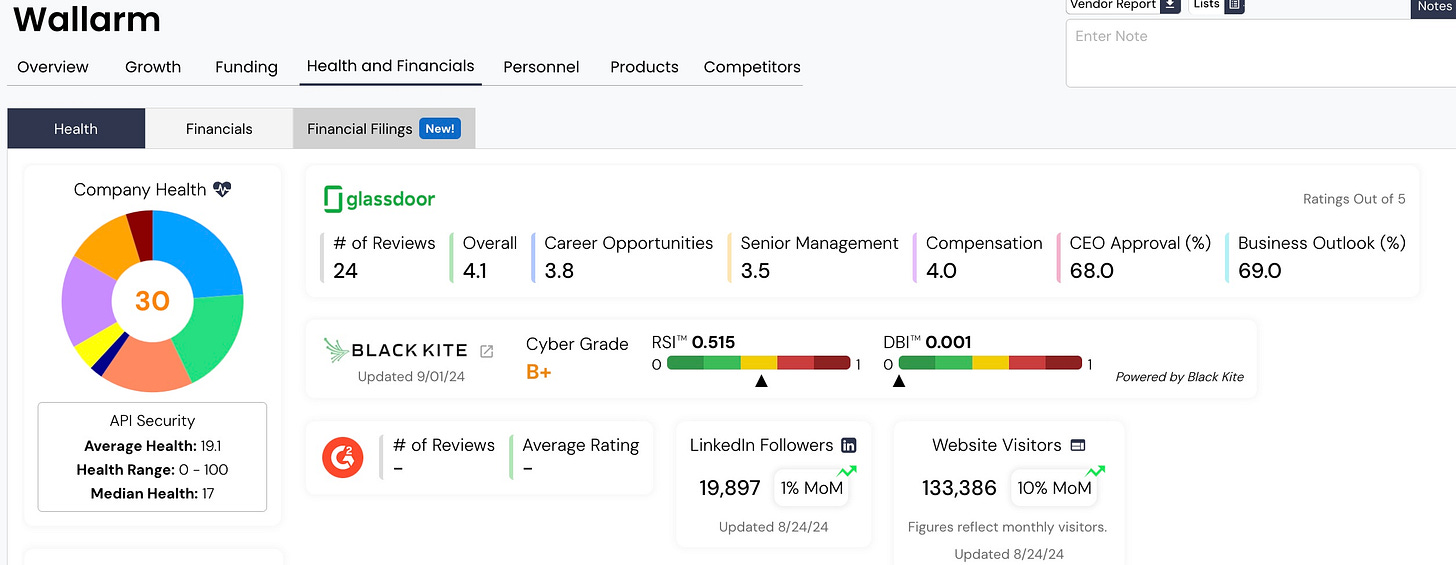

Wallarm’s Health Score is great. Some of the other metrics might be worth watching.

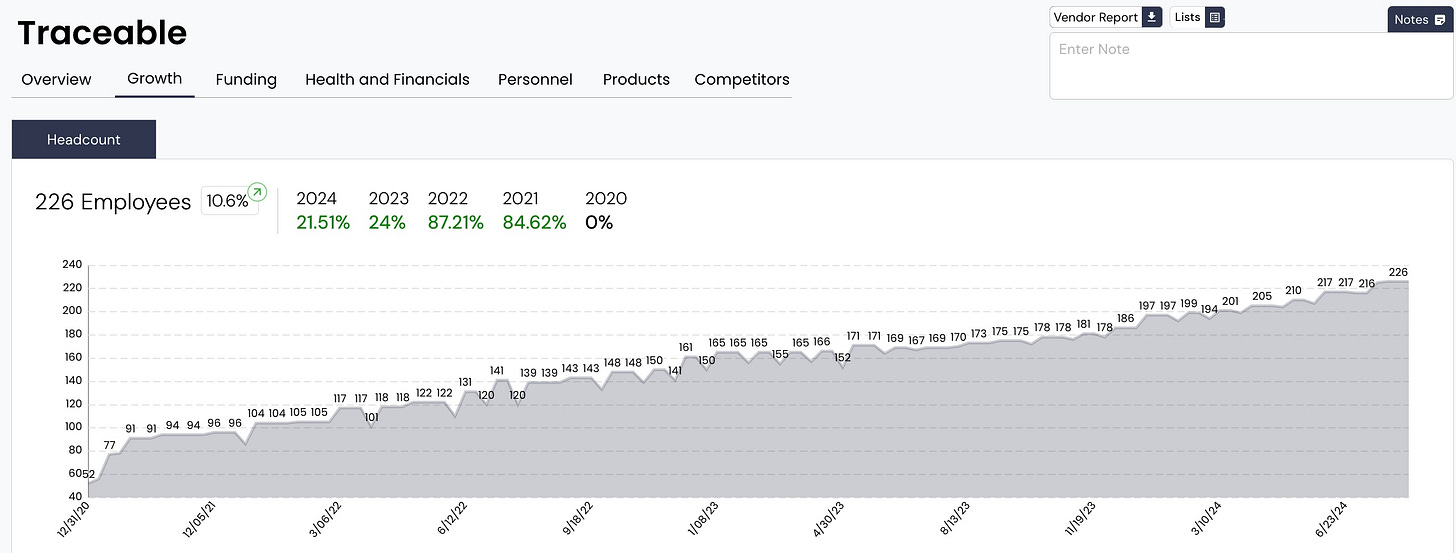

Traceable is a younger company, launching in 2018, the year Wallarm got its series A. It has consistently grown faster and has passed Salt.

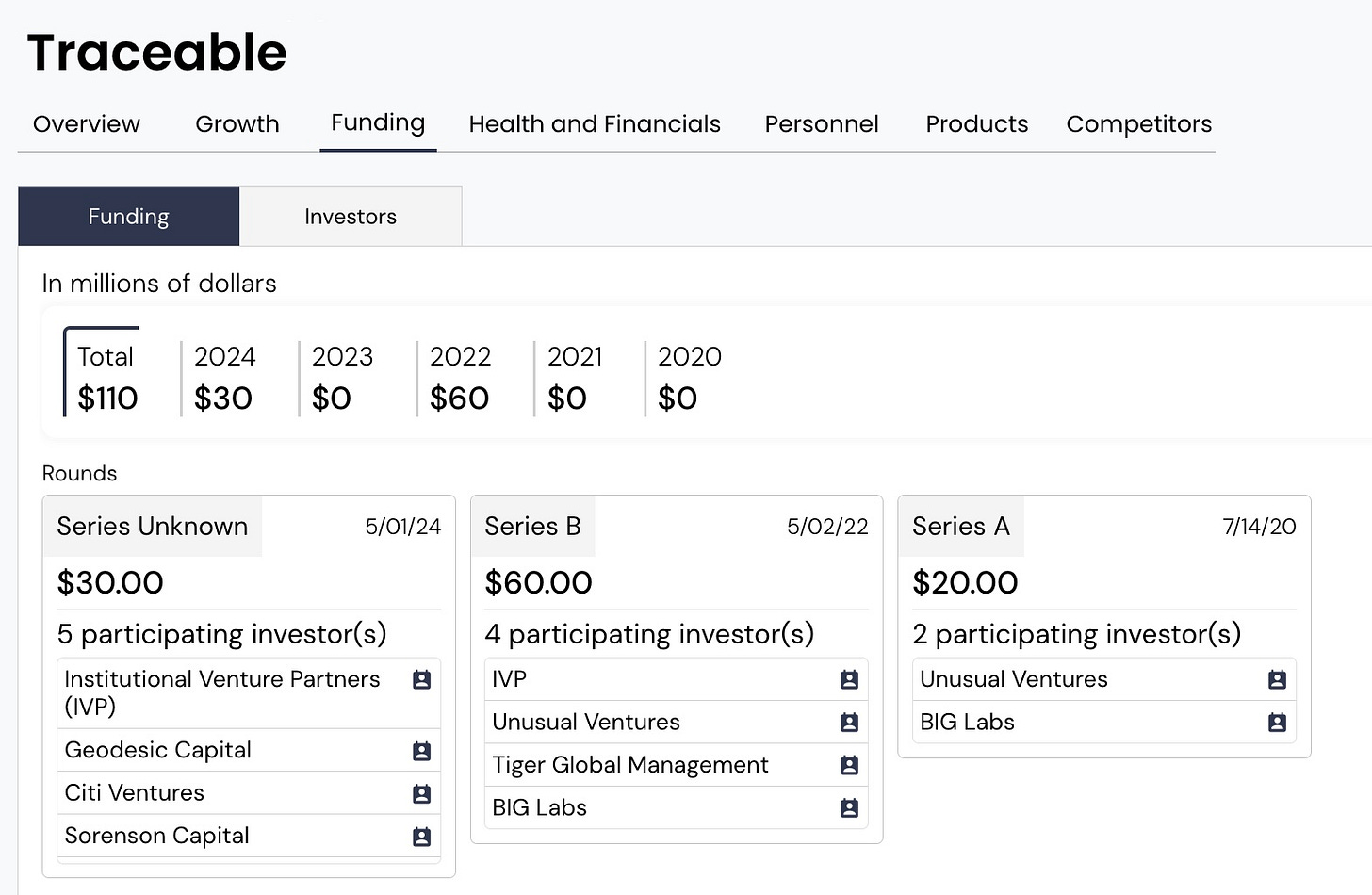

Investors are still pouring money into API Security and Traceable seems to be the favorite with a $30 million round in May.

In 2022, just as our data gathering ability was maturing, API Security was the hottest space, growing 47% that year. The blush is off the rose but it is still a vibrant space with several standouts like Wallarm and Traceable.

Check out the other Cyber 150 awardess in this full spreadsheet.