With over 3,000 vendors in the cybersecurity industry it should be no surprise that there is a vibrant market for selling services and data from one company to another. In addition there are content providers, events, PR firms, and search firms, that sell to cybersecurity vendors.

IT-Harvest’s platform for researching the cybersecurity industry was developed for investors and analysts to quickly parse the entire space to identify winners and losers and gain an understanding for granular trends. The big surprise for us was the discovery of these other use cases.

Say you are an event organizer and want to research vendors that have exhibited at the major cybersecurity conferences like RSAC or BlackHat. We ingested that data and made it a search filter. Since our launch last March we have added 21 conferences. Here are the attendees of RSAC 2022 sorted by ‘22 growth.

It turns out that exhibiting at the big (expensive) events is a sure sign that a company is healthy and thriving. It makes sense because only a company that has the infrastructure to staff a booth, pay for it and travel, and then do something with the leads collected, would invest so much in a conference. If you were looking for sponsors of your own events this data would be a great place to start.

It’s also a great place to start if you are a webinar producer or create white papers or other content for vendors.

Search firms, on the other hand, may have different criteria. Recent funding, growth in headcount, and international expansion are good indicators that companies are hiring.

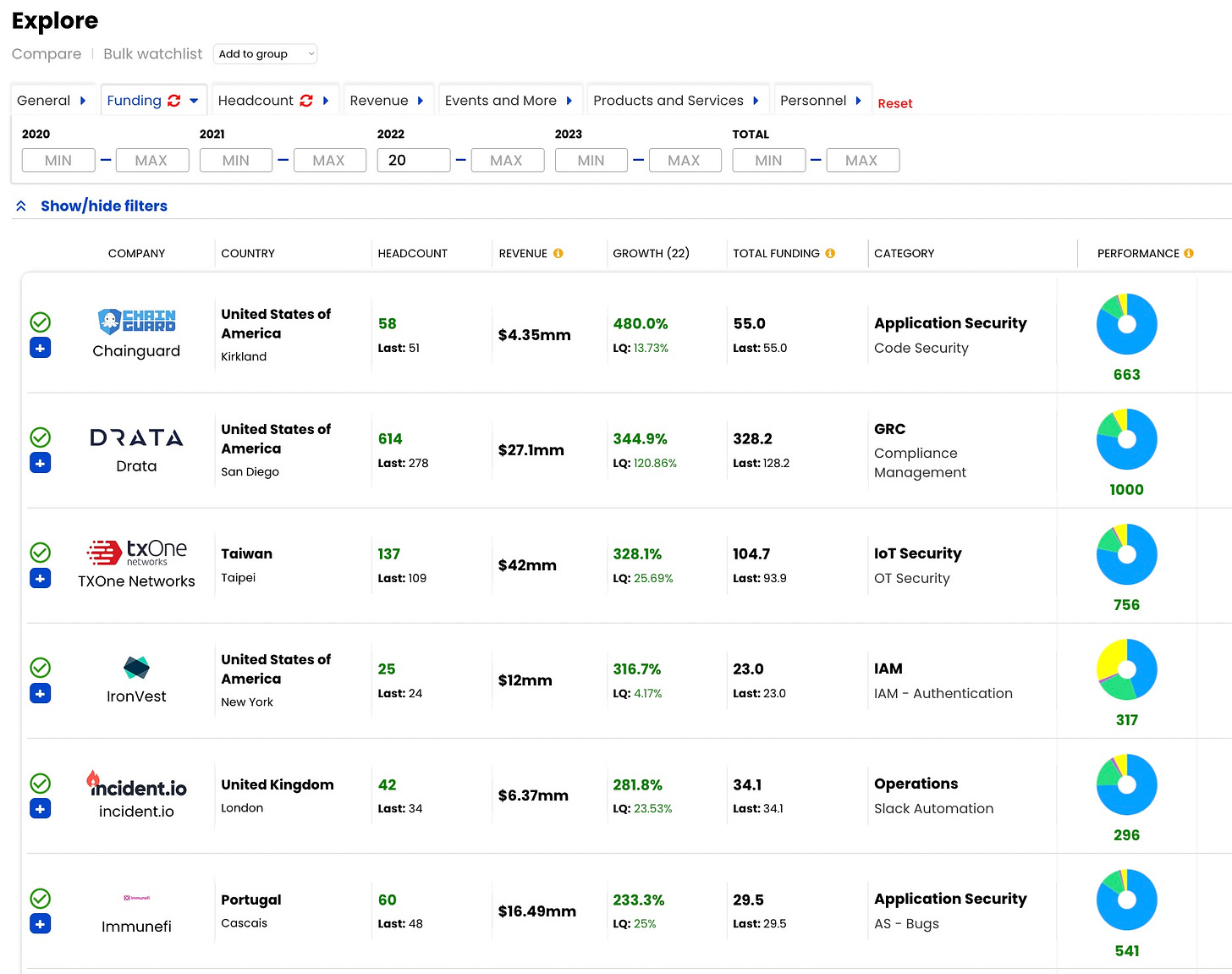

Here are some companies that fit those criteria: 2022 growth over 25%, recent funding of at least $20 million.

What about vendors that have products that they sell to other cybersecurity vendors? OEM relationships are the best path to revenue growth. The endpoint security vendors are best known for this. To launch a complete SMB suite Webroot incorporated virus signatures from another vendor to offer an anti-spyware+AV solution. Threat intelligence vendors often provide the intel they gather from unique sources to the other vendors to enrich their data.

Another example is Anitian. (Full disclosure, I sit on their board.) They help any vendor become Fedramp compliant so they can sell their cloud solutions to the US federal government.

One last example: investment banks. They have a very expensive service they sell to companies: 7% of the total value of the company if they broker a deal to sell the company or take it public. They are constantly on the lookout for up-and-comers and may spend years nurturing a relationship.

Can you think of any other use cases of vendors selling to vendors? Let me know.