The numbers are in and Q3 2022 was not the complete disaster for the cybersecurity industry that is attributed to tech in general. 98 vendors took in funding worth $2.13 billion. Through the three quarters ended September 30 there have been 314 investments totaling $14.98 billion. So yes the 3rd quarter saw a decline, but it was the summer doldrums after all. Besides, there have been $1.4 billion of new investments announced just in the first week of October. At $16.4 billion so far this year the industry is already at 60% over 2020's record of $10.7 billion, although not hitting last year's all time record of $26 billion.

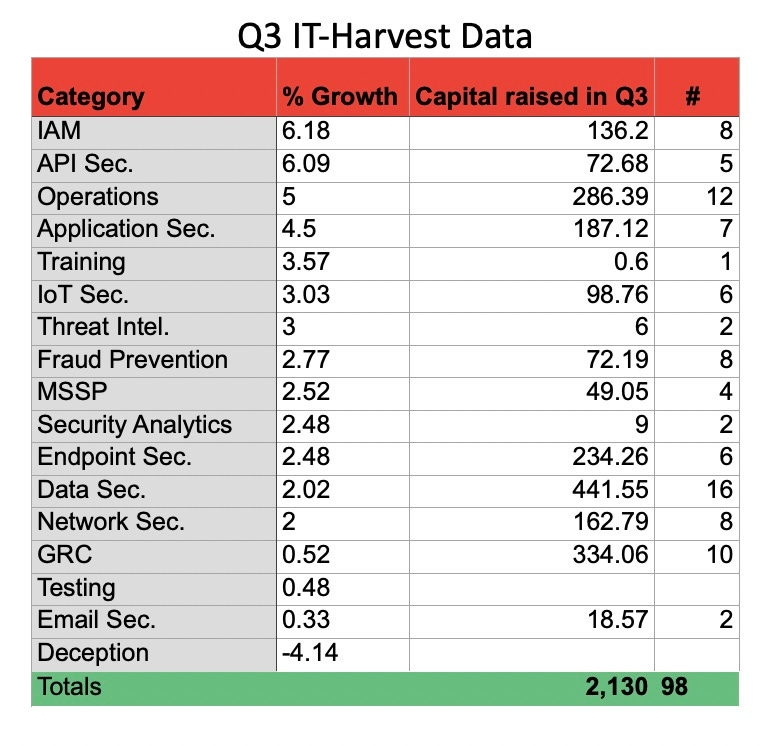

Here is how each of the 17 categories fared in Q3.

(Note that the columns don’t add up to the totals because there was one stealth vendor that received $21 million in funding that has been added).

Identity and API security led the pack with 6% growth in head count. Data Security only grew by 2% but there are a lot of data security companies, 425 to be exact. There were 16 investments in data security totaling $441million.

The Training category is not all training companies. It is primarily those that have cyber ranges or other tools. It is one of the smallest categories at 31 vendors.

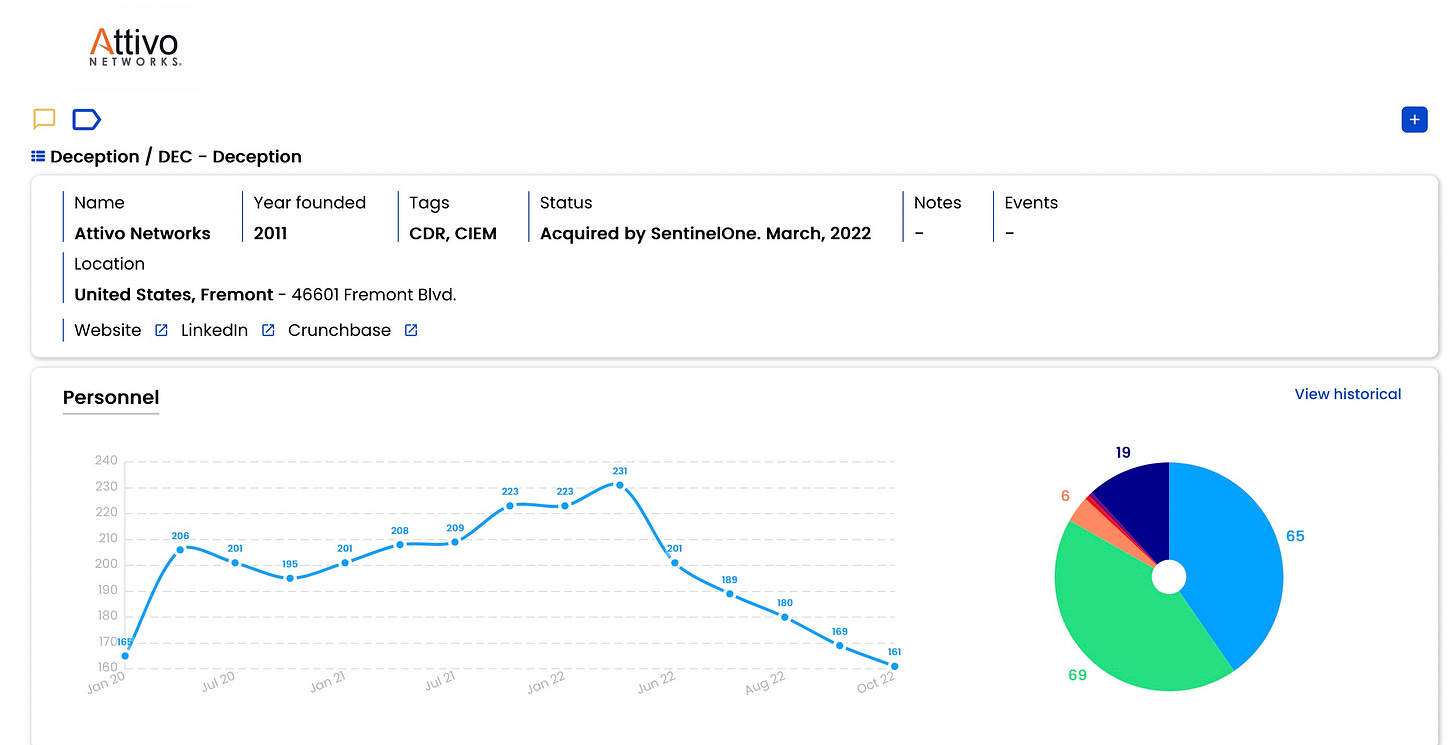

Deception is the smallest category with 17 vendors. The category as a whole has been on the decline ever since Attivo was acquired by SentinelOne in March.

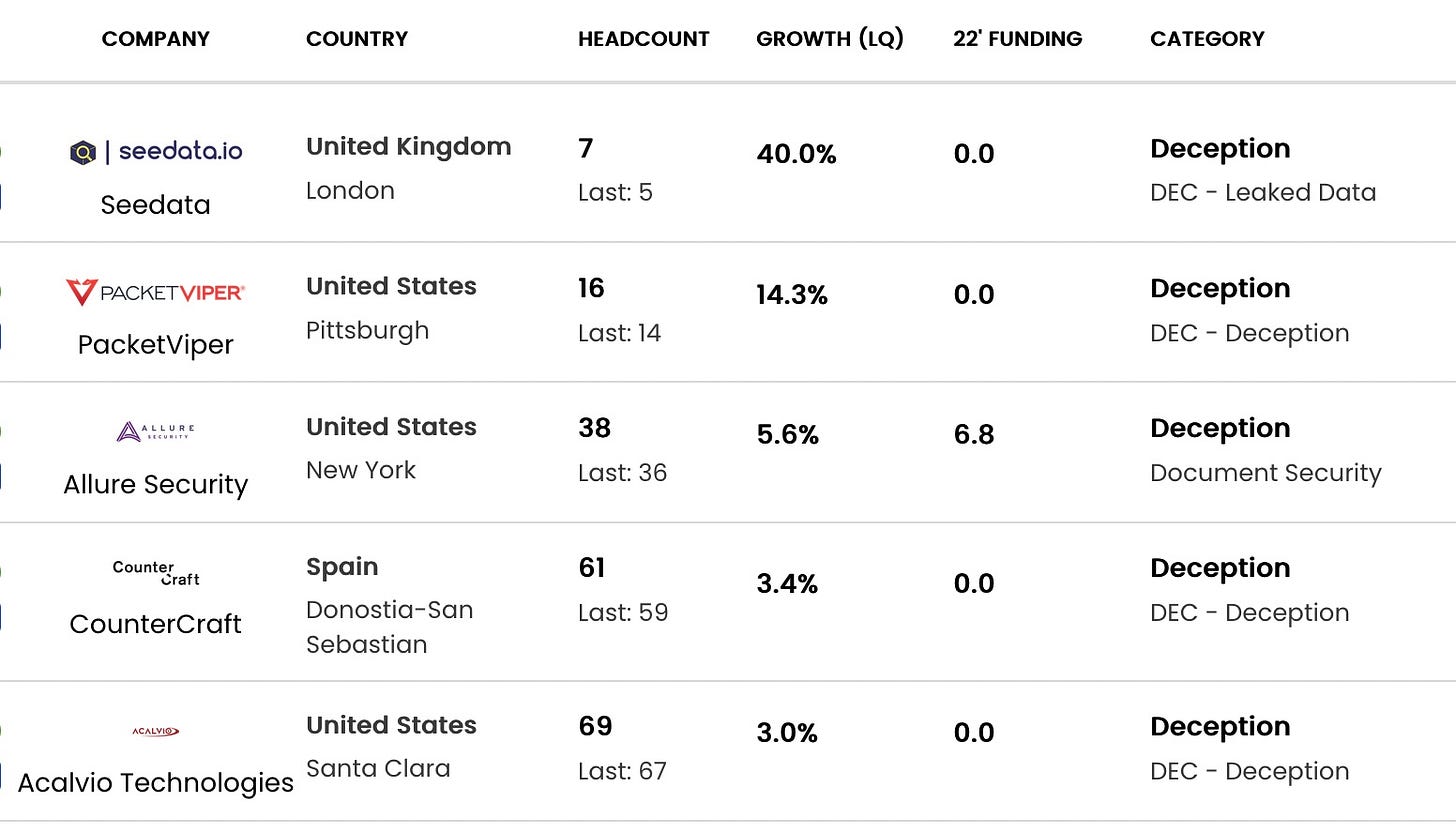

Here are the deception vendors that showed healthy growth in Q3.

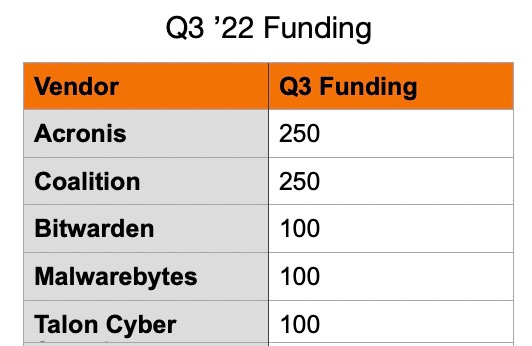

Here are the top five investments in Q3, totaling $800 million.

Acronis, a data back up and recovery vendor has been adding more and more cybersecurity functions to their products. Not surprisingly they message around ransomware. News of the round came on July 29 but it may have occurred earlier in the year. Bloomberg says they think Blackrock was one of the institution investors. Channel Futures, reporting that the funding may be used for strategic acquisitions, quotes:

“Acronis Cyber Protect – is used by over 20,000 service providers to protect over 750,000 businesses globally”

Coalition is one of the few cyber insurance vendors tracked by IT-Harvest because they specialize and take a more proactive approach to insuring companies, charging less if they implement the technology and controls Coalition makes available. It took in $250 million in July, 2022. I am not an insurance expert but I imagine they need to have a lot of capital to cover any future losses on the $775 million in underwriting they claim for this year.

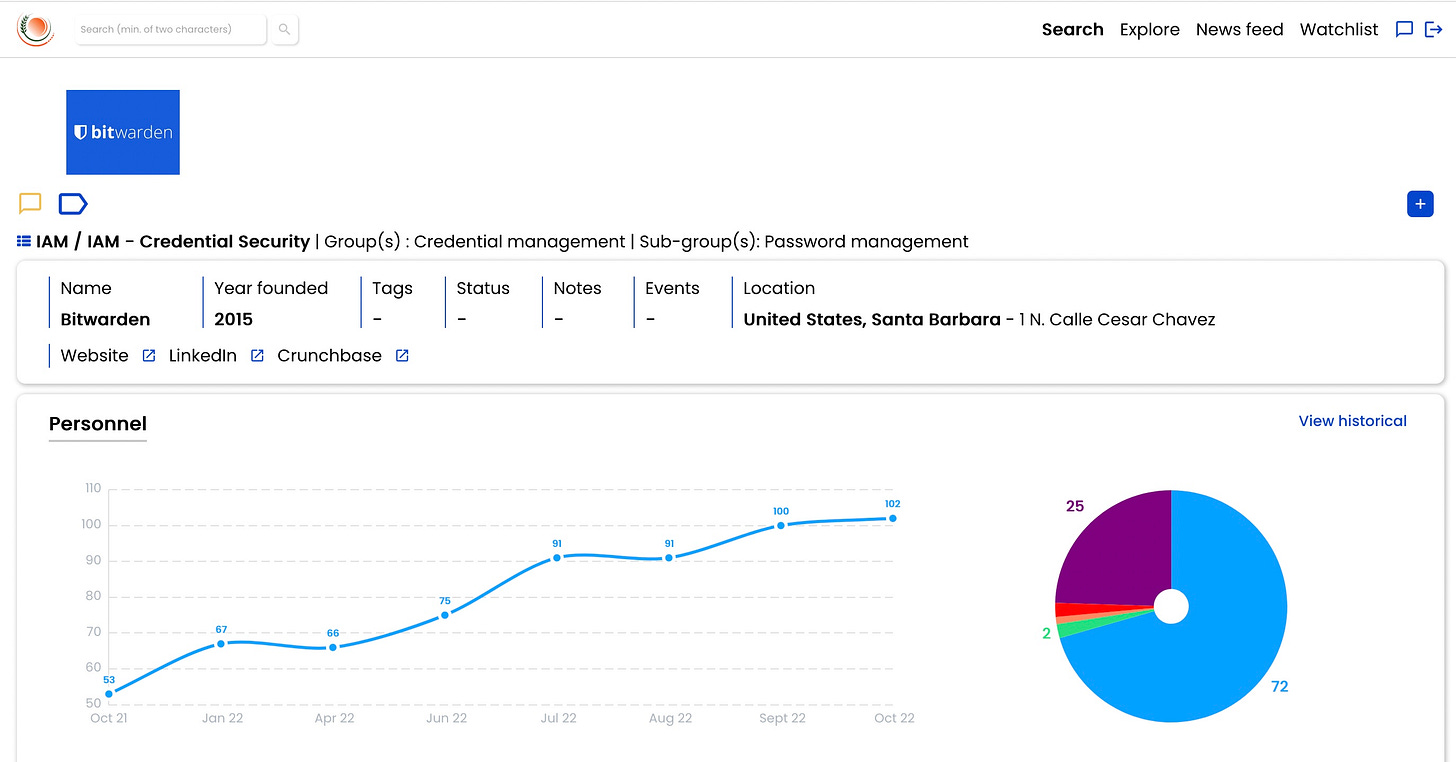

Bitwarden announced a $100 million round in September to fuel growth for its password management solution.

As seen in IT-Harvest’s Bitwarden page, growth in head count has been healthy in 2022.

Malwarebytes was in the news several times in Q3. It was unfortunate timing that they announced $100 million in new funding in September—just when a glitch caused them to block many Google services. The issue was quickly resolved.

Talon Cyber Security, an enterprise browser startup announced $100 million in Series A funding, led by Evolution Equity Partners, with participation from Ballistic Ventures, CrowdStrike’s Falcon Fund, Merlin Ventures, SYN Ventures and previous investors George Kurtz, Lightspeed Venture Partners, Sorenson Ventures and Team8.

Here are the next 10 cybersecurity vendors to receive funding in Q3.

Subscribers to the IT-Harvest Dashboard can quickly filter, sort, and output all 98 vendors which received funding in Q3 (or any data on 3,092 vendors).

So, yes there are dire warnings that the worldwide economy is tanking. Yet most cybersecurity vendors continued to hire in Q3 with notable exceptions that announced reductions in force in Q2. The argument that recessions do not impact cybersecurity spending may hold water as turbulent times lead to increased activity from attackers. Certainly, investors are not overly spooked.