Endpoint Security Category Analysis

In preparation for Hexnode’s Hexcon23 I did a deep dive into the data we have on the endpoint security space. Make sure to register for the September 20-22 online event (free). There are 78 speakers by my count!

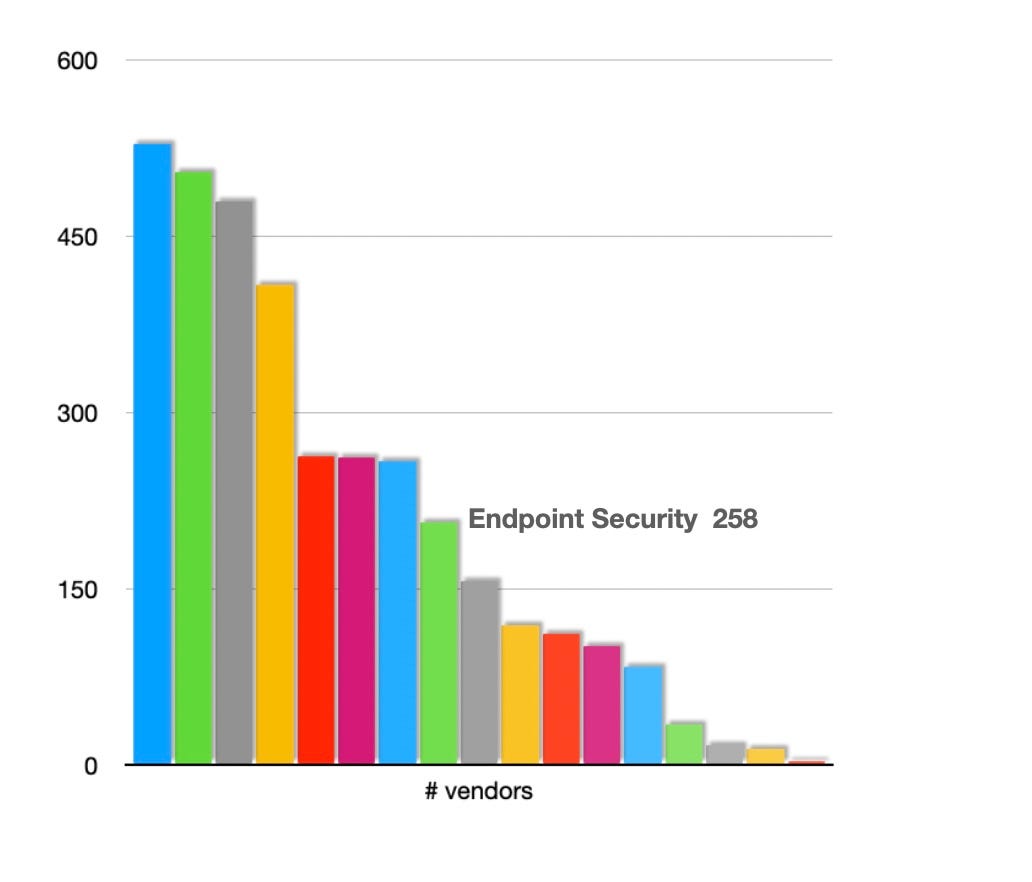

The IT-Harvest Analyst Dashboard tracks data on 258 endpoint security vendors across 36 countries.

What’s an endpoint? My definition is: anything that processes data or instructions. Here is a picture of my father working at one such endpoint in 1973, a LINC8, the precursor to the first DEC mini computer. This was the home computer I grew up with.

Other endpoints include desktops, laptops, servers, VMs, containers, and IoT.

What are the categories of endpoint security?

I am glad you asked. Of course anti-virus vendors like Trend Micro, QuickHeal, and Gen Digital make up the biggest proportion of endpoint security vendors, 45 out of 258.

Only eight years ago endpoint security was one of the top four catagories of security companies along with Network, Data, and Identity. Now it is the 7th largest category.

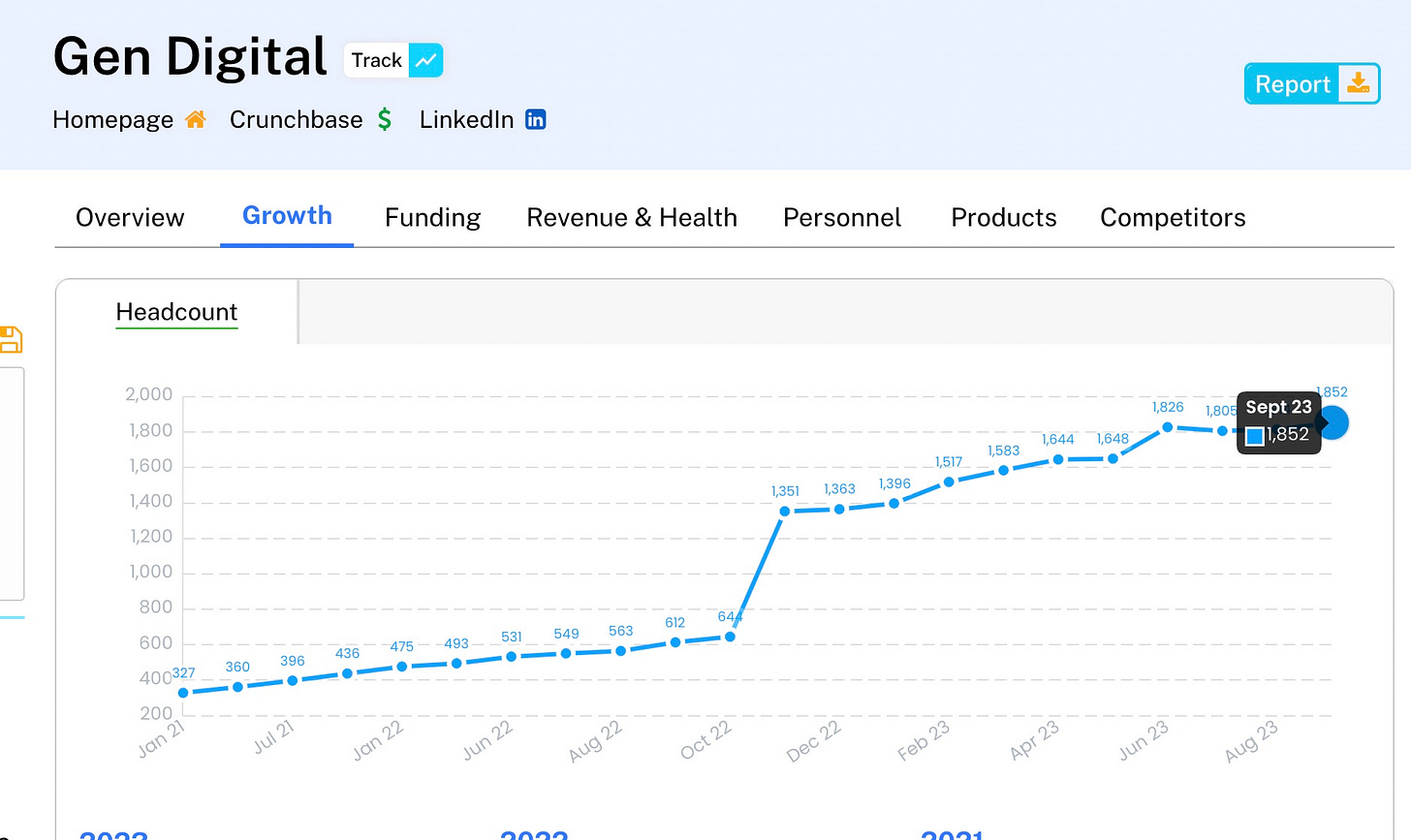

For years I have chastized lazy journalists and pundits for beginning every story about a cybersecurity acquisition with “In a sign of continued consolidation in the cybersecurity industry…” I have written books explaining how M&A is not consolidation in our industry. Well, endpoint security is consolidating. At one point there were over 100 AV vendors. I used to say “When Symantec acquires McAfee, that will be consolidation.” Both Symantec and McAfee were gobbled up by private equity and split into parts. The consumer business of Symantec became NortonLifelock and it began to gobble up AV vendors whose names began with Av. :-) Avast, AVG, and Avira. That is consolidation.

There were two causes for the demise of the AV industry. Crowdstrike and Microsoft. Crowdstrike was well positioned to take over endpoint protection with a better solution. Microsoft was whittling away at the low end of the market with Windows Defender, a free solution.

Note that consolidation, if done well, can turn into outsize profits. At the end of 2022 Gen Digital, the new name for Norton+Avast+AVG+Avira, had $1.5 million in revenue per employee and $600k in profits!

There are still plenty of opportunities for endpoint security vendors. Luckily for them Microsoft does not play in the mobile phone space. IoT is promising too. As things become smarter and smarter they become better targets for attack, to paraphrase Mikko Hypponen.

Tune in to my talk at Hexcon this week!

I personally expect even further consolidation coming soon, especially on the consumer side of things. It looks like this part of Endpoint Security, especially the “Internet Security suites”, will end up being a market with a few players compared to how it was before.