Checking in on cybersecurity funding through May. So far this year there has been a total of $3.85 billion put into 126 vendors. Unless we see a change, the year is on track to hit $9.2 billion in funding which would be less than 2020, and about half of 2022.

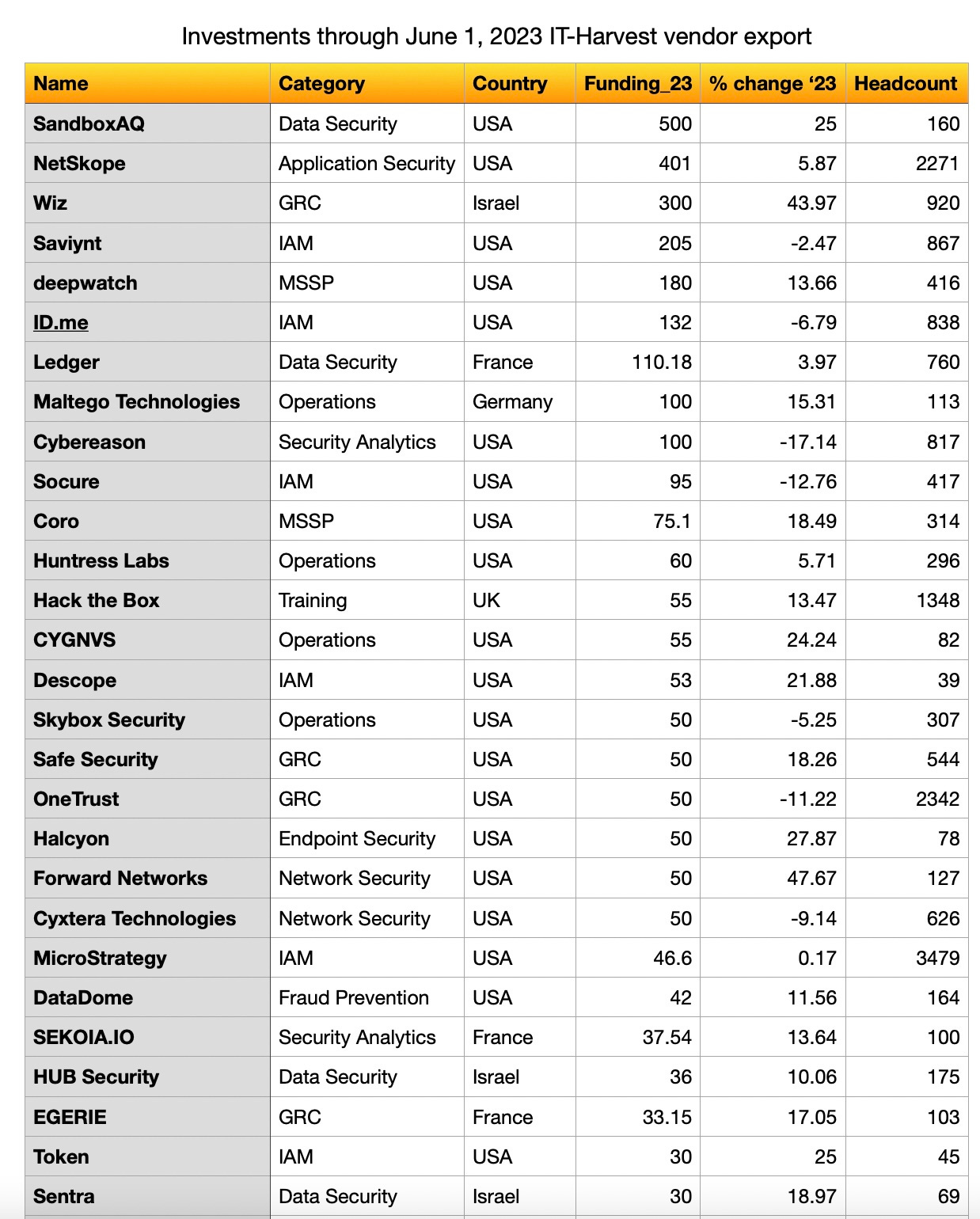

Here are some of the funding rounds we have seen so far.

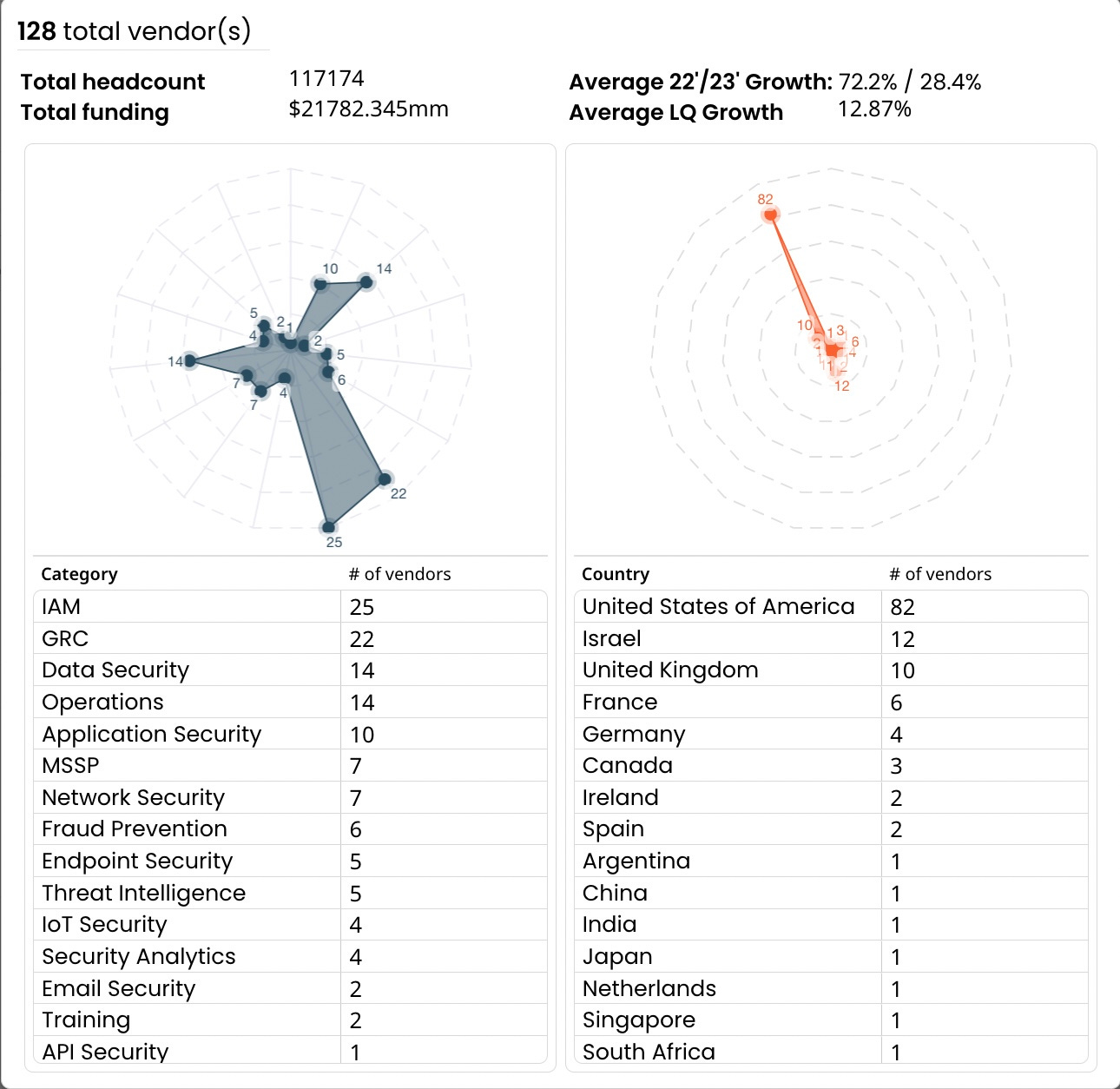

The breakdown by category is notable because the Identity category saw more companies funded than the GRC bucket. This is a change from the last two years.

No surprises in the distribution of new funding by country, although the US outweighs its proportion. 65% of investments were in US companies, while there are 1,840 out 3,453 or 53% of vendors in the US. Always keep in mind that it is generally easier to discover US cybersecurity vendors because they tend to show up at the major conferences and, for that matter, get funding.

It is apparent that the stocks of the top cybersecurity vendors have an outsize impact on new investments–something about the gloomy outlook that took effect in November of 2021 and brought stocks down 60-80%. Perhaps venture capitalists become more conservative when their personal portfolios take a big hit?

The top stocks tracked here hit a low on January 6 this year. Palo Alto Networks and Crowdstrike are riding high with 60+% gains since then. Zscaler has been creeping back up after inexplicably dropping into negative territory earlier. ($153 represents an 80% gain from its low of $85 on May 3rd.)

If the stock market is returning to rewarding growth in cybersecurity (and tech in general) perhaps things will turn around for startups in the second half.

Follow along as we report on the entire cybersecurity industry. IT-Harvest maintains the only platform for cybersecurity industry research. If you could benefit from having all of this data at your disposal reach out for a demo.