Booming UK Cybersecurity Industry

A quick look at the cybersecurity industry in the United Kingdom

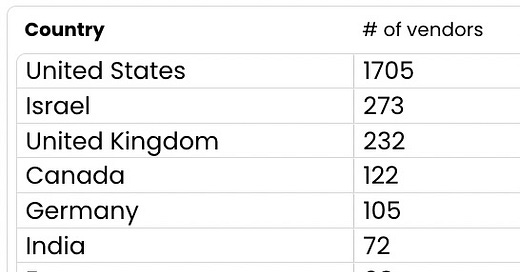

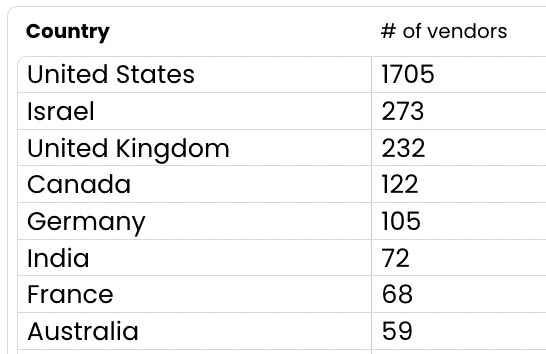

The UK ranks #3 in terms of vendors of cybersecurity products.

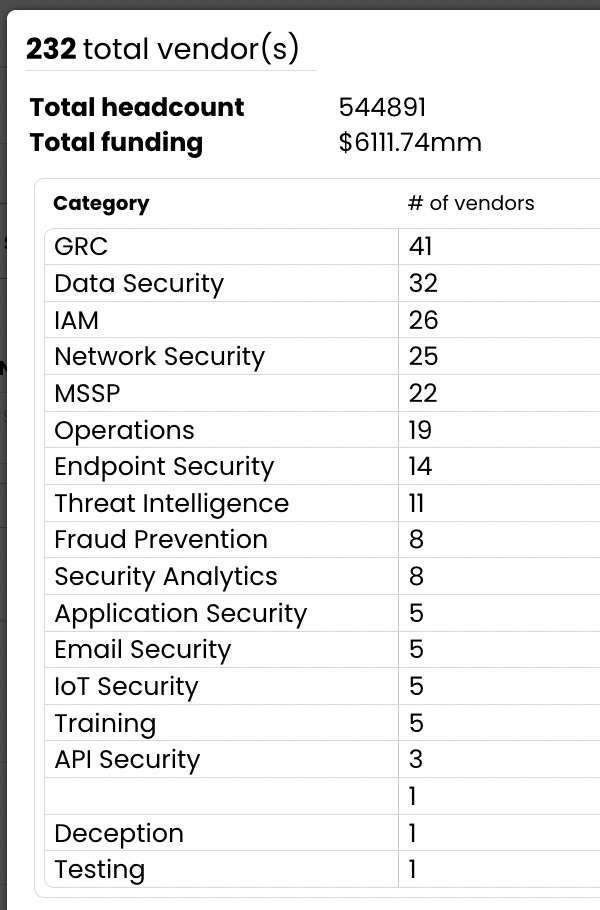

Here is how they break down by category. (All data pulled from IT-Harvest’s research platform available here.)

The anchors of the industry are giant companies like BT, NTT, and EY (all with MSSP businesses.) But it is more interesting to look at the 102 vendors that experienced growth of ten percent or more in 2022, a challenging year. Here are the fastest growing:

The fasted growing cybersecurity company in the UK is Next DLP, which takes a user-centric approach to data leak prevention. They grew 161% in April and then, like alomst every company, cut back on hiring because of fears of a recession. Continuing to hire in the last quarter is a sure sign that a vendor is healthy.

$412 million was invested in 20 companies last year. Not surprising that they all added to headcount. Note that the investment rounds are small compared to Israeli and US startups, although Qredo, IProov, Immersive Labs, and Red Sift, had investments over $50 million.

There are only five UK cybersecurity vendors that have received more than $100 million in funding total.

Snyk has moved their headquarters to Boston and the CEO resides there. We still designate them as UK based, even though more that 50% of their people are in the US.

My own observation is that many UK firms are small and do not have plans for expanding outside the region. 107 have 20 or fewer people. That said, all it takes is for a vendor to demonstrate product-market-fit and the investors will find them and help them go to market in the wider world.

If you want to see the current version of our platform in action please reach out to schedule a demo.

richard@it-harvest.com