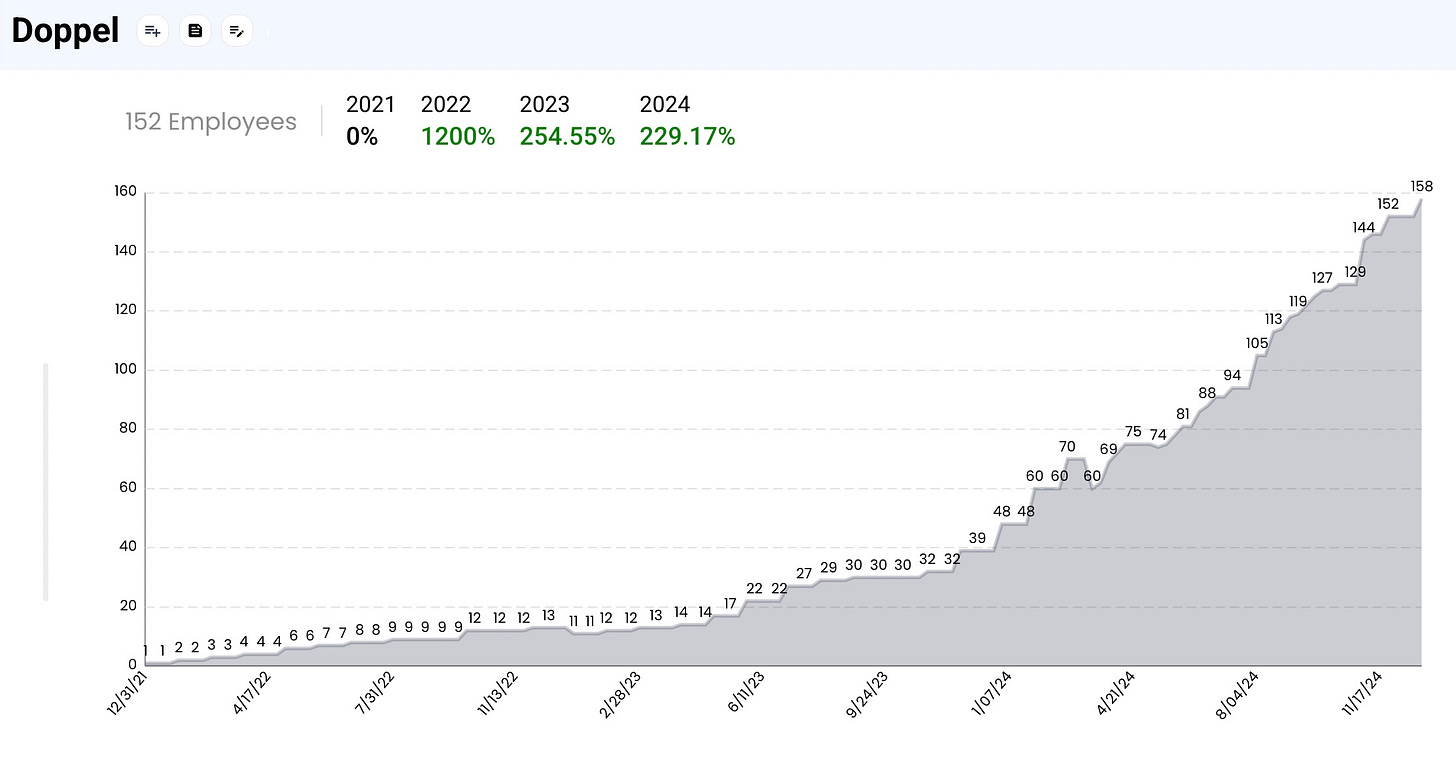

In Security Yearbook 2025 I updated the Cyber 150 to account for a full year’s growth in 2024. The first version of this list looked at vendors that grew 15% in headcount through July 1. We chose a range in size of between 50 and 500 headcount as reported by LinkedIn. Sustained growth is hard, as demonstrated by the fact that there were not 150 vendors which grew at 30%. Some grew as little as 24% which is enviable for any company. Dopple, the fastest growing, had a 217% increase in headcount to 152.

There were 80 new vendors to appear for the first time in the Cyber 150. That means 80 left the list. Some, like OT security vendor Claroty graduated by growing beyond 500 people (755, +28%).

Because there are so many vendors, 4,069 in the Dashboard today, it is helpful to apply some filters to all of the data IT-Harvest tracks to identify the up-and-comers, possibly even the ones most likely to succeed. All of the data used in making the selection was drawn from the IT-Harvest Dashboard, the only platform for researching the entire cybersecurity industry.

The Cyber 150 is a great demonstration of the power of data at your fingertips. Only three filters were needed to create the initial list: Head count between 50 and 500, and growth of 2% in the last quarter. There are 1,111 companies in this range of headcount. If you add the requirement that they grew in the last quarter by 2% that shrinks the candidates to 516. Output those and choose the top 150 by headcount growth to get the final list. I then culled some that just did not fit. Chronicle for instance was in the list. Google keeps an active LinkedIn page for Chronicle, yet has moved that business into Google Cloud Security. Other companies that were removed were bug bounty and training/cloud ranges. Both these categories have thousands of people who put the company in their LinkedIn profile so the data is way off.

In total, the Cyber 150 companies have taken in $8.6 Billion in funding, $2.6 billion of that in 2024. There is no surprise that fast growing companies are spending investor money. But it works the other way too. Fast growing companies attract investor money. By the end of 2024 the Cyber 150 employed 18,591 people.

Eighteen of the Cyber 150 more than doubled in size last year. The minimum growth in headcount was 24%. There is no funding reported for 26 of them while 63 took in fresh investment in 2024.

Doppel led in growth last year.

Check out the growth curve for the threat intelligence company:

You may not have heard of the others. That is what applying filters to data does. It raises the visibility of otherwise hidden gems. Here are the Dashboard descriptions for each:

Confidencial, founded in 2022 and based in the United States, is a data security cybersecurity vendor specializing in protecting sensitive and unstructured data.

Linx Security, founded in 2023 and based in the United States of America, is an Identity and Access Management (IAM) cybersecurity vendor. The company offers the Linx Identity Security Platform, which integrates with existing IAM stacks to manage and secure digital identities across organizations.

Zafran, founded in 2022 and based in the United States of America, is an operations cybersecurity vendor. The company offers the Zafran Threat Exposure Management Platform, a consolidated solution that integrates with existing security tools to reveal, remediate, and mitigate exposure risks across an organization's infrastructure.

Admin By Request, based in the United States of America and founded in 2008, is an IAM cybersecurity vendor that specializes in managing local admin rights.

Aikido is a Belgium-based application security company founded in 2022, offering a comprehensive DevSecOps platform that provides code-to-cloud security scanning and protection for applications.

Chainguard, founded in 2021 and based in the United States, is an application security vendor specializing in secure container images. The company offers a suite of CPU and GPU-enabled container images, including popular frameworks like PyTorch, Conda, and Kafka, which are hardened, minimal, and optimized for efficient software development and deployment.

LayerX is an Israel-based Endpoint Security cybersecurity vendor founded in 2021. The company offers a browser security platform designed to turn any browser into a protected and manageable workspace.

Blockaid, founded in 2022 and based in Israel, is a cybersecurity vendor specializing in fraud prevention. The company provides advanced onchain security, primarily for web3 companies, by focusing on transaction simulation and validation.

Dynamo AI, founded in 2021 and based in the United States of America, is an AI Security cybersecurity vendor. The company offers a comprehensive suite of solutions designed to address privacy, security, and compliance challenges in AI systems.

Note that Israeli startups often establish a headquarters in the US. Zafran is one of them.

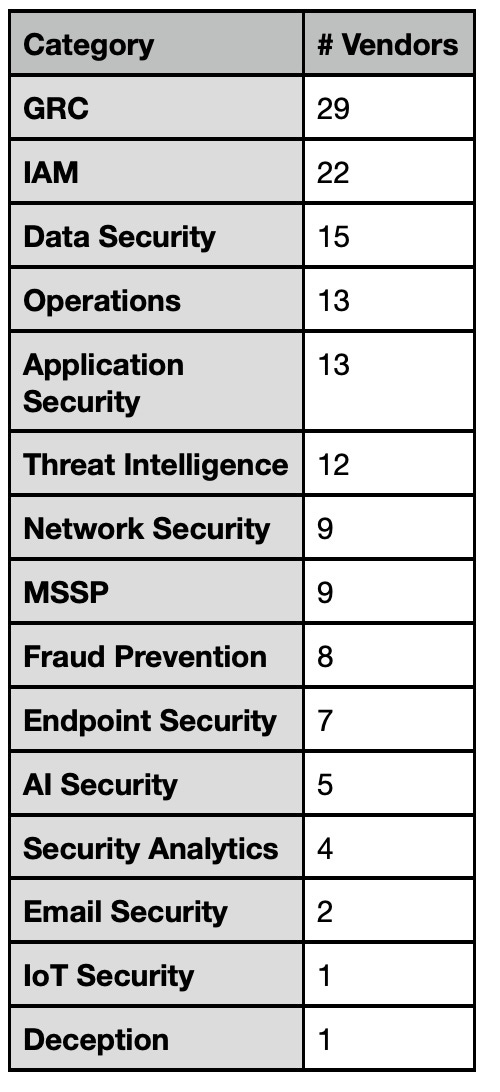

Here is how the 2025 Cyber 150 breakdown by category:

And by country:

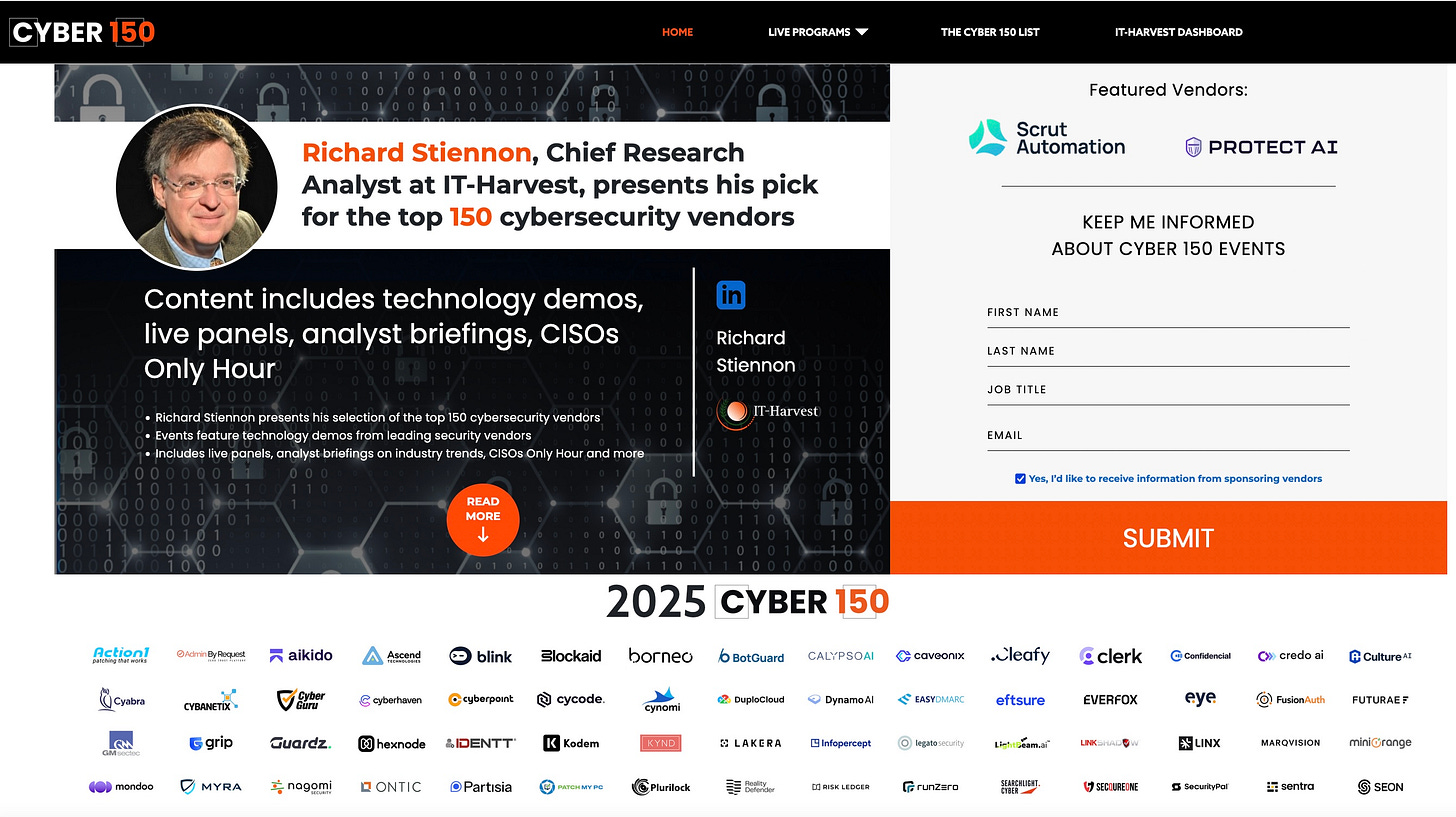

And here is the list of the entire 2025 Cyber 150. You can also learn more and see demos and interviews at cyber150.com a joint project with Cyber Symposiums.

And don’t forget to pre-order a copy of Security Yearbook 2025: A History and Directory of the IT Security Industry. This year’s edition is dedicated to the memory of Amit Yoran who was kind enough to contribute his pioneering story starting with the 2021 edition.