Many investors and researchers go through the painstaking task each year of filtering through the exhibitor list for the RSA Conference. At IT-Harvest that task falls to Salaar. He has painstakingly gone through the exhibitors several times. Out of the 537 booths in the Expo this year 401 belong to cybersecurity vendors. The rest belong to integrators, consultants, resellers, national pavilions, media companies, professional societies, schools, and of course, the FBI and NSA.

Last year’s Expo had 335 vendor exhibitors.

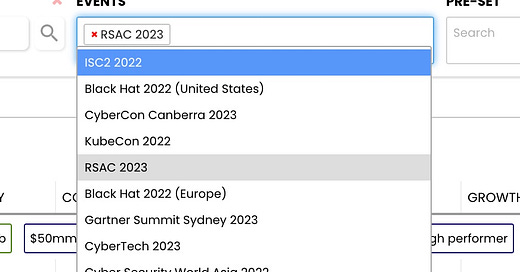

The IT-Harvest Dashboard records the exhibitors at many conferences including, BlackHat US, Blackhat MEA, Infosec Europe, and 25 more. Once the conferences are ingested we can quickly gain insights from the data by filtering on a particular conference.

One click to see how they break down by category and country.

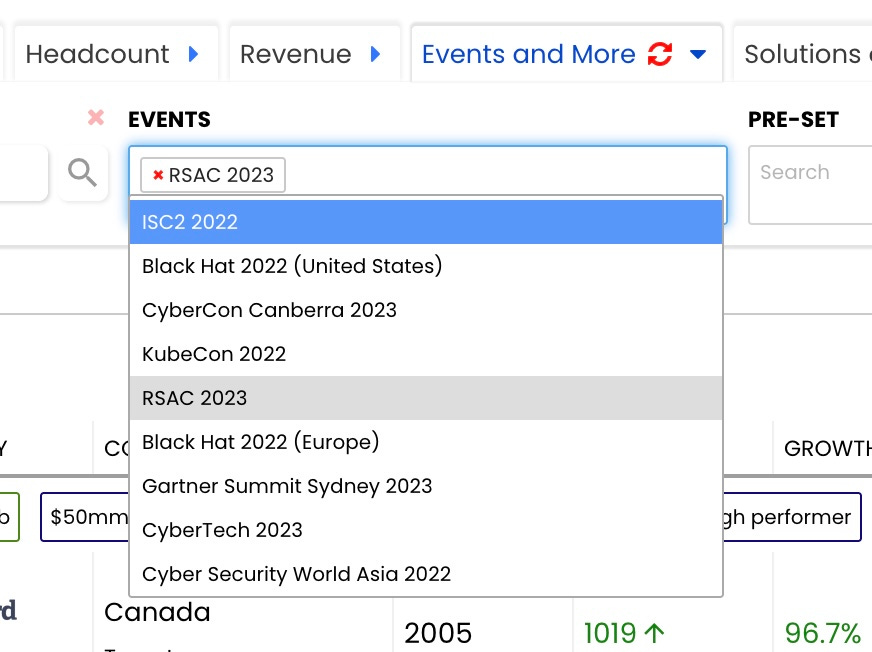

Governance, Risk, and Compliance (GRC) is the biggest category with 58 exhibitors. Here are the top ten by percent growth in head count last year.

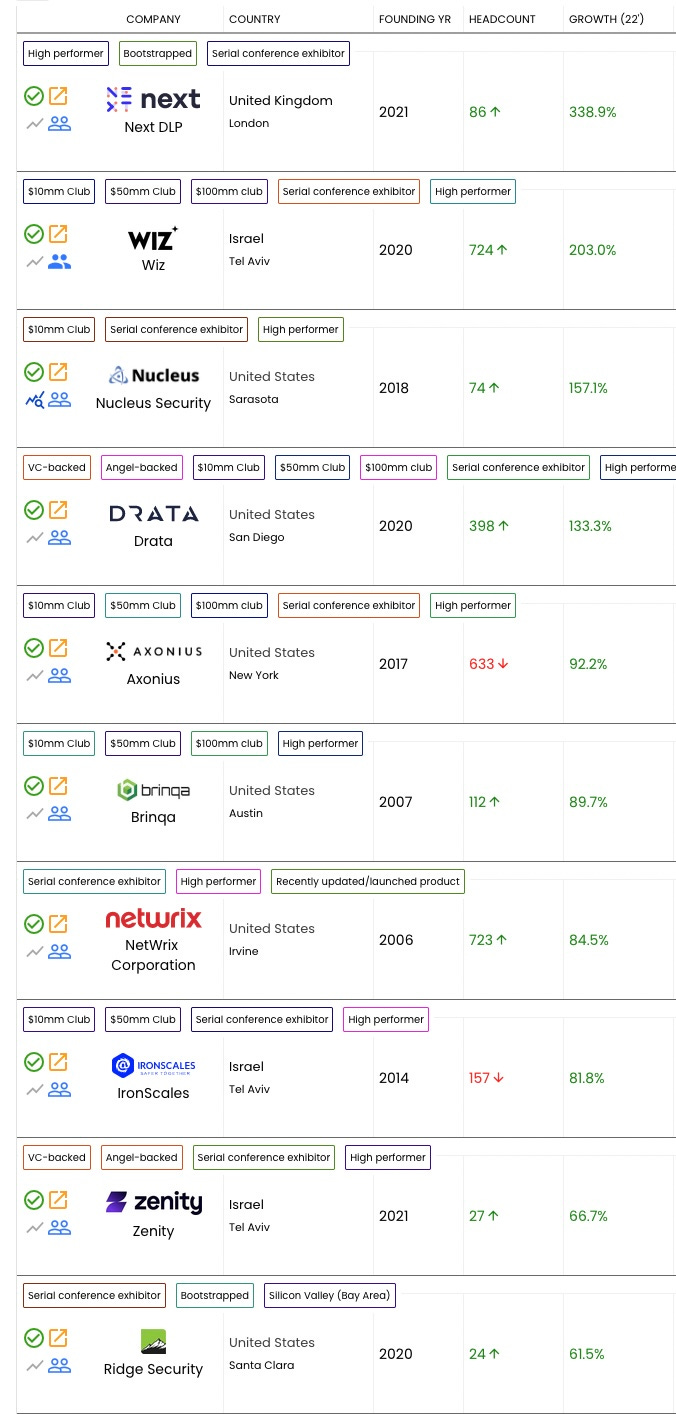

Next DLP, a London head quartered startup, grew over 4X in 2022. Most of that growth came in Q1.

The large number of exhibitors bodes well for the industry. Exhibiting at the major conferences entails a lot of spending. First for the booth space, then for the booth construction, and finally the cost of sending the large team to populate the booth. Not to mention the side events, dinners, and business suites for meetings.

San Francisco has 248 hotels containing 35,000 rooms. Most are already sold out. You can still get a room at the W across from Moscone Center for $1,200 a night.

If we learned one thing last year it was that investors in tech companies were advising their portfolio companies to cut back on spending and hiring. Many did, announcing large layoffs.

Only five pulled out of RSAC. They are Rapid7, Ping Identity, BlueVoyant, One Identity, and Red Sift. According to Reuters, Rapid7 is exploring a sale. It is no surprise that they would cut spending to beef up the financials. Ping Identity was taken private by Thoma Bravo last year, so also not a surprise that they would attempt to improve their financial picture.

Making the decision to appear at RSAC is not one made lightly. It has to be justified by continued traction in the market. A presence at the biggest event of the year signals anticipation of continued growth in sales.

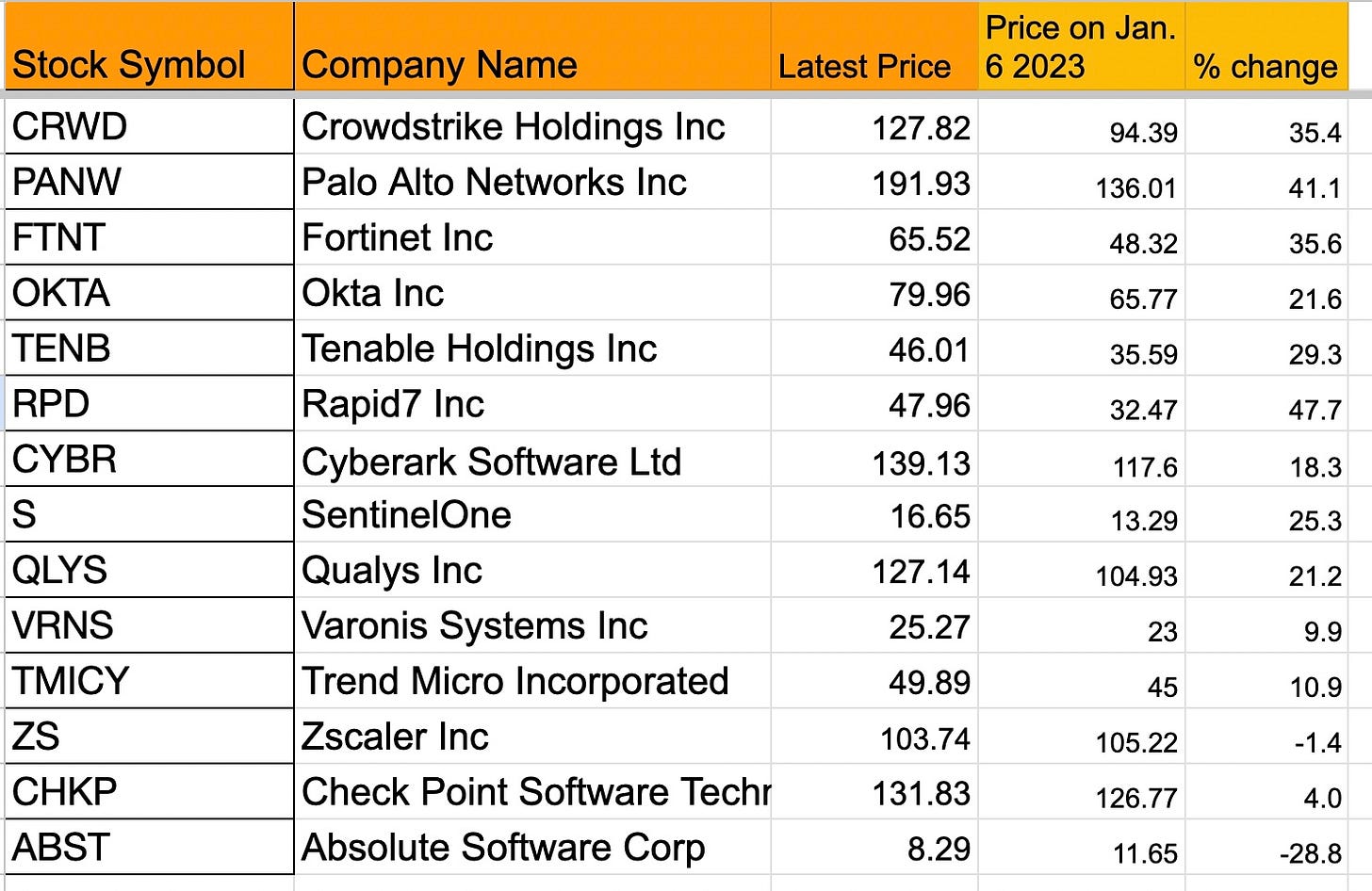

If one tracks the stock prices of some of the bigger names in cybersecurity you see that they hit bottom on January 6. Rapid7’s stock price for instance is up 48%.

My conclusion: The cybersecurity industry is healthy and growing. We track 3,335 vendors at dashboard.it-harvest.com. Valuations may suffer this year because of a general pull back in investments, especially after the failure of SVB. M&A activity will most likely hit a record as companies are snapped up because they are running out of cash. But there will be more startups launched and all the vendors that are cash flow positive are going to have a very good year.

If you would like to receive a spreadsheet of the 401 exhibitors simply fill out this form. You will also get updates on the only platform for researching the cybersecurity industry.