On January 3rd I rushed to post our findings on cybersecurity investments for 2024. It turns out I missed a few, 34 to be exact. Mark Sasson, whose recruiting firm tracks investments, posted his end-of-year summary too. Thankfully, he also reports the details of those investments on the Pinpoint Search Group website. His numbers were so different than mine that I had to dig in and find the mismatch.

After a busy weekend I have verified 34 rounds we had not captured. Now the final numbers are in. There were 432 cybersecurity companies that took in new funding in 2024. The total of $16.1 billion was the third highest amount in history and up 60% from the $10.05 billion in 2023. The years that beat these numbers were 2022 with $17 billion and 2021 with $26 billion invested in 474 companies. It would not be surprising if 2025 comes closer to $26 billion than $17 billion. So hold on tight for an exciting year.

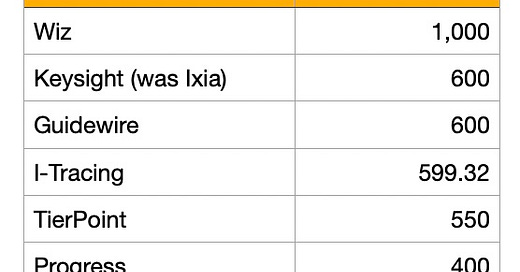

Here is a quick snapshot of the biggest investments.

As is often the case, “funding” at these levels may not be traditional VC funding. I-Tracing for instance is a large MSSP in France that was first acquired by PE and then raised additional funding. It is often pointed out that Cribl is not strictly a cybersecurity company. It is the only non-cybersecurity vendor in the IT-Harvest Dashboard which curates data on 4,028 companies. The reason it is included is that so many CISOs purchase Cribl to manage security data.

The billion dollar round taken in by Wiz continues its remarkable story. Look at headcount growth for Wiz, up 77% in 2024. Wiz is already twice the size Zscaler was when it filed to IPO. After turning down a $23 billion offer from Google in July the path to an IPO is clear.

There were 42 investments over $100 million. (I remember 2005 when I joined Webroot Software and its $108 million “investment” was one of the few of that size that year. I use scare quotes because $80 million of that went to the the founders to buy out their shares.)

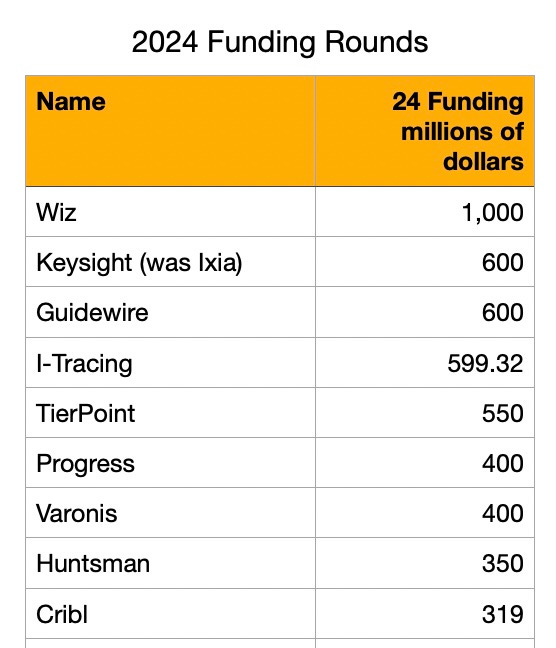

Here are the eight rounds of exactly $100 million.

There were also a bunch of funding rounds with undisclosed amounts. These include SDG

ThreatMon

Ripjar

Cloudguard

Terrazone

AKEYLESS

Tidal Cyber

Query

Cyvatar

Typically, undisclosed rounds are down-rounds or tuck-ins to tide a company over to extend runway.

The general consensus is that the tech market is back on track and 2025 will exceed 2024 funding and M&A levels. The data shows that 1,878 (46%) of 4,028 vendors grew in headcount in 2024 while 2,150 shrunk (54%). Fifty-fifty is normal for the five years we have been tracking headcount with the good years leaning towards more growing than shrinking. So 2024 was in no way overly exuberant. Perhaps that means there is pent up demand for hiring in the new year.

See all the data on 2024 funding and M&A, by pre-ordering Security Yearbook 2025 today. Delivery will be in May or you can stop by and get a signed copy at RSAC.

The story of Wiz is truly amazing