1H 2024 Cyber Security Industry Health Check

$8.26 Billion in cybersecurity investments so far this year

2024 is on track to hit $16.5 billion in cybersecurity investments, a 64% jump over 2023. If investors overcome their qualms acquired when Silicon Valley Bank failed last year, this could very well be a breakout year for the industry.

In the first half of 2024 there were 215 investment rounds in 213 companies. That’s right, a couple of vendors took in two rounds. Not included are the “undisclosed” investment rounds.

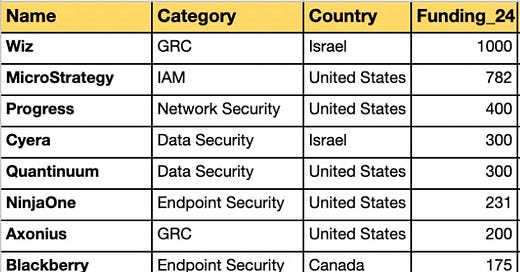

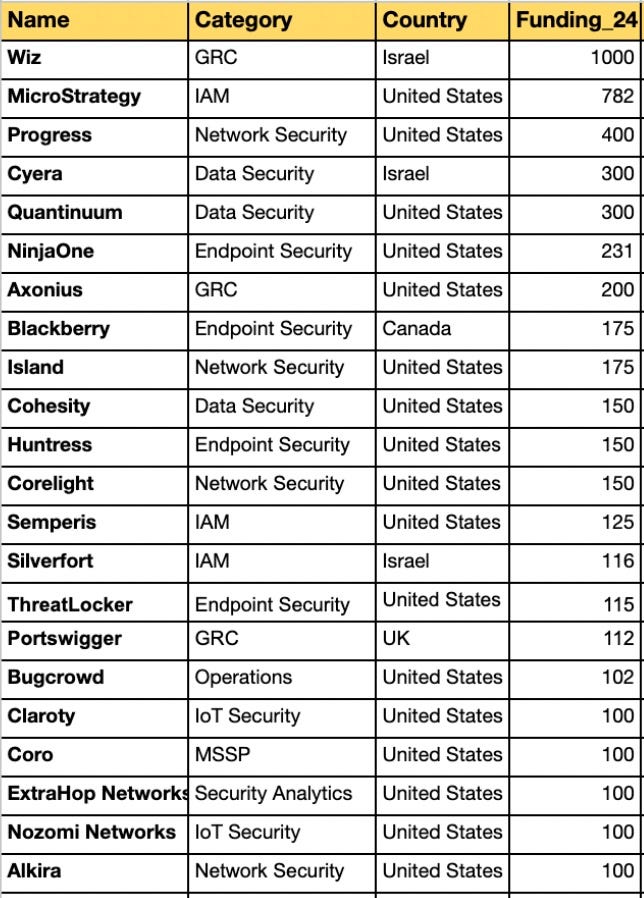

The blockbuster investments in Wiz (a cool $1 billion), and Cyera ($300 million) topped the charts for pure play cyber companies. Twenty two vendors took in $100 million or more. We track any vendor that has security products, thus the inclusion of Progress, a business application holding company that is publicly traded. In addition to owning Chef, Progress has a secure file transfer product called MOVEit which has been in the news lately for a major breach. MicroStrategy has a mobile app for identification. And Blackberry, surprisingly, is primarily a security company.

Thirteen vendors took in between $50 and 100 million. Ninety seven took in $10 million or less.

Through the end of May, 1,483 vendors (38%) out of 3,893 tracked, grew their headcount while 1,202 shrunk (31%).

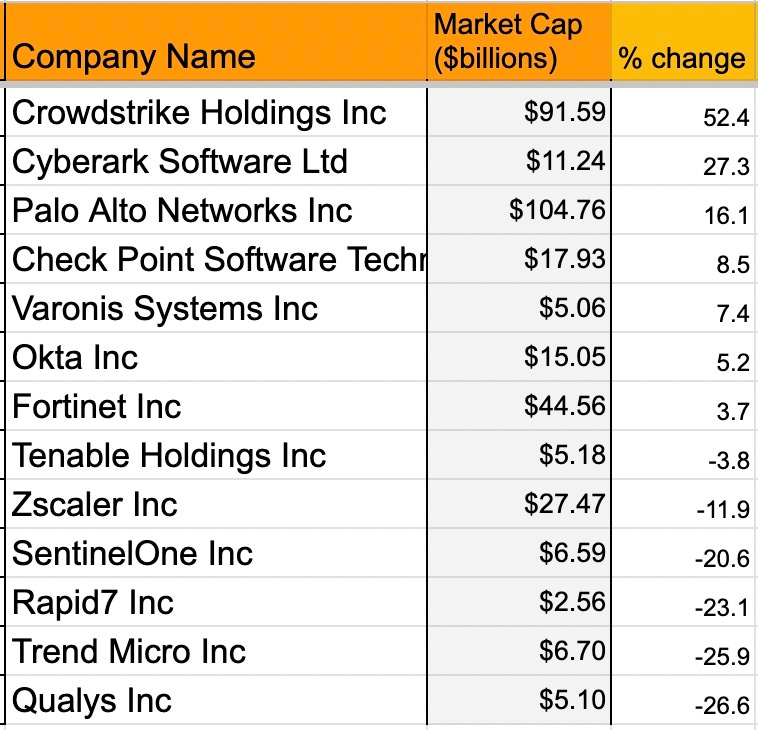

Meanwhile public cyber stocks have been a mixed bag in the first half. At close on Friday this is how they stood.

Crowdstrike continues to report growth in revenue and was added to the S&P 500 last Monday. It’s market cap has grown 52% to $91.6 billion. Cyberark has become the belle weather for the identity space and has done well so far this year with a 27.3% jump.

Palo Alto has recovered nicely from the debacle that is “platformization” which sent its stock into a nosedive in February. It is back in the $100+ billion market cap category. It is the largest pure-play cybersecurity product company by revenue but could lose the market cap contest to Crowdstrike.

The negative performance turned in by Zscaler, SentinelOne, and Trend, indicates that the markets are not universally enthralled with cyber stocks. In my observation public market stock performance has a near real time impact on funding from VCs. So, unless things pick up for these stocks, I don’t expect VC investment to surpass $17 billion in 2024.

$17 billion in new investments is a healthy number, on top of that there are several newly raised funds which adds to the “dry powder” waiting to be deployed. Also, we are not done with the wave of AI security startups.

Very insightful as usual, Richard! Hope you don’t mind I will use some of this data somewhere else, with the appropriate attribution.

Yes we hack also saw a funding round. France based, bugcrowd competitor.